April 28, 2023

-

- Revenue from Non fixed odd wagering games, horse racing and pin codes $7.53 billion (2022: $7.22 billion), a 4% increase year over year.

- Income from fixed odd wagering games, net of prizes $5.33 billion (2022: $5.49 billion), a 3% decrease year over year.

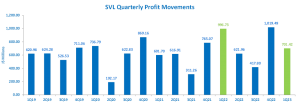

“Total gross ticket sales for the quarter amounted to $27.8 billion, relatively flat in relation to Q1 2022, The Lotteries segment reported gaming income of $5.93 billion and achieved results of $1.06 billion. This represents a decrease of $108.88 million, or 1.8%, on gaming income while segment results showed an decrease of $89.57 million, or 7.81%.”

“The Sports Betting segment reported results of $320.46 million and gaming income of $3.7 billion, an increase of $251.51 million, or 7.16%, when compared to the prior year’s gaming income. The growth is due significantly to the attractiveness of the offers and flexibility and access to game, enhanced by the use of the mobile platforms.”

“PIN codes sales saw a decrease of $2.79 million or 3.3 percent for the quarter, achieving segment results of $81.50 million.”

Direct expenses recorded a 2% increase to close the period under review at $10.05 billion when compared to $9.84 billion for the same period in 2022. Gross profit for the quarter shrunk by 2% to $2.84 billion (2022: $2.88 billion). Management stated, “This increase in expenditure represents costs associated with our preparation to enter the Ghanaian market as a service provider and other strategic initiatives expected to “bear fruit” in the third quarter going forward.”

Selling, general and administrative expenses grew by 14% for the quarter to $1.86 billion (2022: $1.63 billion), while SVL booked other income of $85.00 million relative to other income of $114.04 million in the prior comparable period.

Consequently, operating profit for the period declined 22% to $1.07 billion relative to $1.36 billion reported in the same period last year.

Finance cost amounted to $143.64 million relative to the finance cost of $98.67 million reported in the corresponding period in 2022. Profit before taxation amounted to $924.06 million, down 27% from $1.26 billion recorded in the previous comparable period.

Taxation for the quarter declined 19% to close at $212.10 million when compared to $260.52 million incurred in 2022. As such, net profit after tax for the three months period amounted to $712.00 million, a 29% decrease from the $1.00 billion recorded for the prior corresponding period.

Net profit attributable to shareholders amounted to $701.42 million (2022: $996.73 million).

Earnings per share totaled $0.27 for the period under review (2022 $0.38). The twelve months trailing earnings per share amounted to $1.04. The number of shares used in our calculations is 2,637,254,926 units. Notably, SVL’s stock price closed the trading period on April 28, 2023, at a price of $28.70, with a corresponding P/E ratio of 27.58 times.

In addition, SVL stated that “ Digital innovations such as our lottery online platform SV Games, access to sports betting online through Just Bet Mobile, casino type games with Acropolis Online and horseracing through MBet are all growing mobile channels, from which we expect great things to continue. Our flagship lottery products continue to grow and the introduction of the “Scratchaz” games has been an overwhelming success. The SVL group’s digitization is comprehensive and its potential for growth is exponential.”

Balance Sheet at a glance:

As at March 31, 2023, Supreme Ventures Limited total assets base amounted to $18.49 billion relative to $18.19 billion a year earlier, a 2% increase year-on-year. The increase was due mainly to increases in ‘Property, plant and equipment’ and ‘Goodwill’ which closed at $4.84 billion (2022: $4.76 billion) and $4.35 billion (2022: $4.26 billion), respectively.

Shareholders’ equity amounted to $5.39 billion (2022: $4.55 billion), resulting in a book value per share of $2.04 (2022: $1.72).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.