May 17, 2023

In United States dollars (except where it is indicated otherwise):

Sygnus Credit Investments Limited reported net interest income of US$4.98 million, a 6% decrease on the US$5.30 million recorded in 2022. Interest income closed the period under review at US$9.11 million (2022: US$7.24 million). Interest expenses had a 113% jump, closing at US$4.13 million (US$1.94 million). For the quarter net interest income of US1.62 million (2022: US$1.62 million) was recorded.

The Company also reported fair value gain of US$2.08 million or the nine months relative to a fair value gain of US$669,023 for the comparable period in 2022. Sygnus noted, this was mainly due “from the investment in AFC, referred to as Puerto Rico Credit Fund (“PRCF”) investment income. This amount is formally carried on the income statement as part of fair value gains since AFC is not consolidated all the way up to SCI.”

Other income closed at US$164,097 (2022: US$18,055). For the quarter, other income totaled US$130,495 versus US$5,000 recorded in the same quarter last year.

As such, Sygnus reported nine months total revenue of US$7.22 million compared to US$5.99 million last year. For the quarter, Sygnus booked total revenue of US$2.34 million versus US$1.92 million for the quarter ended March 31, 2022.

Total Expenses for the period amounted to US$2.73 million, a 13% decrease relative to US$3.13 million recorded for the corresponding period in 2022. Total expenses for the quarter amounted to US$822,380 relative to US$1.55 million for the same quarter of 2022.

Profit before tax for the nine-month period amounted to $4.49 million versus $2.86 million in the previous corresponding period.

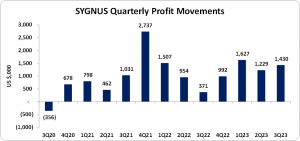

Net profit and comprehensive income for the nine months ended March 31, 2023 amounted to US$4.29 million, relative to US$2.83 million in 2022, a 51% increase year over year. For the quarter, the Company booked a net profit and comprehensive income of US$1.43 million compared to a net profit of US$370,666 for the same quarter of 2022.

As a result, Earnings per share (EPS) for the period amounted to US$0.008 (2022: US$0.005). EPS for the quarter amounted to US$0.003 relative to an EPS of US$0.0006 in 2022. The twelve months trailing EPS amounted to US$0.015. The number of shares used in our calculations amounted to 348,239,700 units. Notably, SCIUSD and SCIJMD last traded on May 17, 2023 at US$0.10 and J$11.58, respectively.

Management noted, “The results for the nine-month period were driven by record portfolio investments in private credit, “investment income” from the underlying value of the investment in Acrecent Financial Corporation in Puerto Rico, continued disciplined investment origination and the structuring of investments with adequate downside protection to manage risk exposures. SCI’s private credit portfolio remains resilient and well positioned to navigate the ongoing volatility of the current high interest rate environment, with a robust, lowly leveraged balance sheet and robust pipeline of investment opportunities.”

Furthermore, “SCI intends to launch a redeemable preference share capital raise to maintain its capital mix, while supporting the growth and expansion of its origination pipeline particularly from Jamaica. Subsequent to the end of the quarter, SCI paid US$1.00 million in dividends to shareholders, bringing total dividends paid since its initial public offering in 2018 to US$10.35 million. On May 12, 2023, the Board of Directors approved a share buyback program spanning a period of 3 years for an amount of up to US$9.00 million.,” as per SCI.

Balance Sheet Highlights

As at March 31, 2023, Sygnus’ total assets amounted to US$151.63 million, a 12% increase on 2022’s assets base of US$135.06 million. This was due to an increase in ‘Investments’ to US$140.62 million (2022: US$122.90 million), reflecting a 14% or US$17.72 million year over year increase. SCI management noted, “This was mainly comprised of US$140.97 million in private credit investments including US$25.33 million in the Puerto Rico Credit Fund, US$23.81 million in investments measured at fair value through profit and loss, US$91.48 million in investment measured at amortized cost and US$354.0 thousand in finance leases measured at amortized cost.”

Total Stockholders’ equity as at March 31, 2023, closed at US$69.20 million, relative to US$66.47 million for the corresponding period last year. This resulted in a book value per share of US$0.117 compared to the value of US$0.112 as March 31, 2022.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.