November 1, 2022

Transjamaican Highway Limited (TJH)

For the nine months ended September 30, 2022:-

Figures are quoted in United States dollars (except where it is indicated otherwise):

Transjamaican Highway Limited (TJH), for the nine months ended September 30, 2022, reported a 25% increase in revenue which totalled US$47.02 million, relative to US$37.46 million in the corresponding quarter last year. Revenue for the quarter amounted to US$16.72 million compared to US$13.90 in Q3 2021.

Other gains amounted to US$157,000 for the nine-month period (2021: US$1.58 million). The Company noted, “other gains comprised primarily of the gains produced by financial market operations and resulting financial income on investment instruments and the change in value of equity investments. Under the Concession Agreement, the Company also has the right to collect revenues generated from commercial exploitation of the areas surrounding the Toll Road, including gas stations and related ancillary services, electricity and telecommunication cables and fiber optics.”

The decrease in other gains was due to, “foreign exchange losses emanating from the revaluation of the 8.0% (JMD) Cumulative Redeemable Preference Shares.”

Operating expenses totaled US$29.14 million versus the US$24.99 million in the comparable period last year, a 16% increase year over year. “the increase was primarily due to higher amortization of intangibles associated with the traffic recovery, higher Operator’s fee associated with the movement of the exchange rate and CPI. Other increases included cost associated with new marketing campaign and legal & professional fees” as per TJH.

Administrative expense rose 44% to US$1.02 million (2021: US$774,000).

Finance cost for the nine month period was US$11.18 million when compared to US$11.51 million for the corresponding period last year. Finance cost for the quarter were 3% lower than Q3 2021, amounting to US$3.75 million (2021: US$3.85 million)

Profit before taxation closed at US$5.84 million 230% higher than the US$1.77 million reported in 2021.

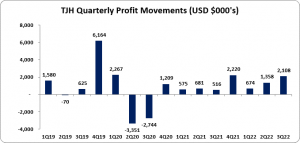

The Company reported taxation of $1.70 million for the nine months ended September 30, 2022 (2021: nil). This resulted in a net profit of US$4.14 million 134% higher than the US$1.77 million reported in the corresponding period last year. Net profit for the quarter closed at US$2.11 million (2021: US$516,000).

Consequently, earnings per share (EPS) amounted to US0.0003 cents for the quarter ended September 30, 2022 relative to US0.0001 cents last year. For the quarter, EPS amounted to US0.0002 cents (2021: $0.00004 cents). The twelve months trailing amounted to US 0.000509 cents. The number of shares used in this calculation was 12,501,000,000 shares. TJH traded on October 31, 2022 at J$1.37 while TJHUSD closed at US$0.0095 with a corresponding P/E of 17.64 times.

Balance Sheet at a Glance:

As at September 30, 2022, total assets closed at US$309.18 million relative to US$316.36 million the prior year. This decline was attributed to the 6% decrease in ‘Intangible asset’ which ended at US$215.20 million (2021: US$228.89 million). This was offset by an 11% increase in “Restricted Cash” US$65.18 million and a 46% increase in cash and bank balances to US$ 7.31 million.

Shareholders’ Equity totalled US$51.27 million (2021: US$58.81 million) resulting in a book value of US$0.0041 (2021: US$0.0047).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.