November 13, 2020

tTech Limited (tTech), for the nine months ended September 30, 2020, booked a marginal increase in revenues to $262.63 million compared to $262.08 million recorded for the prior financial year’s corresponding period. Revenue for the third quarter declined 12% to $92.35 million relative to $105.17 million for the same quarter of 2019.

Cost of sales increased by 13% to $84.25 million from $74.87 million reported for September 2019. As such, gross profit decreased 5% for the period to $178.38 million (2019: $187.21 million). Gross profit for the quarter reduced by 5% to close the quarter at $61.78 million (2019: $64.93 million).

Other income rose to $10.75 million for the nine months relative to $9.49 million in 2019, while administrative expenses rose 7% year over year to $152.31 million (2019: $141.76 million). Other operating expenses for the period reflected a 35% decrease year over year to $18.38 million compared to $28.06 million recorded in 2019.

Operating profit for the period under review totaled $18.44 million, 31% less than the $26.88 million booked for the corresponding period of 2019. Year to date, tTECH booked finance income for 2020 of $1.63 million compared to $1.10 million recorded in the prior year’s corresponding period and finance cost of $1.80 million (2019: nil).

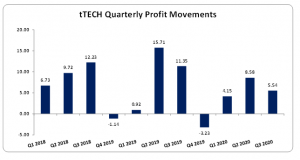

Consequently, no taxes were recorded for the period, thus net profit for the nine months amounted to $18.26 million versus $27.99 million booked for the same period of 2019. Net profit for the quarter declined 51% to $5.54 million relative to $11.35 million reported for the third quarter of 2019.

The earnings per share (EPS) for the quarter amounted to $0.05 compared to $0.11 reported in 2019. EPS for the period totaled to $0.17 (2019: $0.26). The trailing twelve months EPS amounted to $0.14. The number of shares used in our calculations is 106,000,000 units. The company’s stock price closed the trading period on November 12, 2020 at $5.75.

The noted, “Digitalization and Digital Transformation has become the most important topics in leadership circles with the pandemic being the biggest catalyst. tTech delivers value to its customers by allowing them to outsource infrastructure management that has become increasingly complex for organizations whose IT resources are stretched as a result of a growing demand for mission critical digital projects. During the quarter we successfully onboarded a number of new customers, while managing service improvement projects for several existing customers.”

Furthermore, “In July tTech had reopened its office in response to the government’s “back to office” call. However, as the number of COVID‐19 cases spiked in August we reverted to working from home for the safety of our team members. Despite these changes, our support team managed to address support incidents very well, meeting and, in many cases, exceeding our customers’ service level agreements.” Also, “As more companies have their employees working from home rather that in office, the risks associated with Cybersecurity have increased. This has led to tTech reminding organizations of the Cybersecurity risks associated with remote work from home while offering services to mitigate the risks. During the quarter we also focused on educating the market about tools & technologies for Remote Work, Business Continuity as well as IT Security. For further information on these topics please visit our social media pages on Facebook, LinkedIn, Instagram and Twitter,” stated the Company.

Balance Sheet Highlights:

As at September 30, 2020, the Company reported total assets of $331.06 million, 22% above the $270.74 million reported as at September 30, 2019. This was as a result of a 76% increase in ‘Short-term Investment’ to close at $95.70 million (2019: $54.36 million). ‘Right of use Assets’ and ‘Inventories’ also contributed to the increase in total assets by amounting to $26.07 million (2019: nil) and $36.67 million (2019: 14.43 million), respectively.

Shareholders’ Equity as at September 30, 2020 was $235.01 million compared to $219.97 million for the comparable period of 2019. This resulted in a book value per share of $2.22 compared to $2.08 the prior year.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein