May 14, 2020

tTech Limited (tTech), for the three months ended March 31, 2020, booked a 32% increase in revenues to $87.55 million compared to $66.47 million recorded for the prior financial year’s first quarter. Ttech noted, “Security Awareness Training and CyberSecurity threat response activities contributed to the revenue growth as we helped more customers put in place solutions to reduce risks in this area. The tTech IT Security team continued to be kept busy delivering vulnerability testing services, IT systems penetration tests, and providing guidance on IT security to new and existing customers. Our monthly recurring revenue from the provision of Managed IT Services grew in Q1 as we added new customers and a number of our customers’ growth drove their procurement of additional services from us. Implementation of collaboration and unified communication solutions also contributed positively to our results, as we continue to migrate clients away from on‐premises email systems to the Microsoft 365 environment.”

Cost of sales rose significantly by 128% to $26.97 million from the $11.83 million reported for the three months ended March 31, 2019. Gross profit increased 11% for the quarter to $60.58 million (2019: $54.64 million).

Other income totalled $3.10 million for the three months relative to a loss of $2.37 million in 2019, while administrative expenses rose 17% year over year to $51.64 million (2019: $44.05 million). Other operating expenses for the period reflected a 1% marginal growth year over year to $7.84 million compared to $7.79 million recorded in 2019 corresponding quarter.

Operating profit for the first quarter totalled $4.19 million, 861% greater than the $436,000 booked for the corresponding quarter of 2019. TTECH booked finance income for the first three months of $566,000 compared to $322,000 recorded in the prior year’s corresponding quarter. Whereas, finance cost amounted to $607,000 for the three months ended March 31, 2020 (2019: nil).

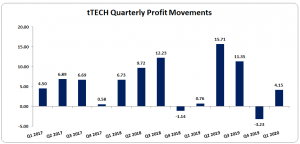

Consequently, no taxes were recorded for the period, thus net profit for the quarter amounted to $4.15 million versus $758,000 booked for the same quarter of 2019.

The Company noted, “tTech was kept very busy helping our customers implement the technologies needed for their staff to operate remotely. We were able to respond immediately to the call by the government to implement Work from Home. With the investments that we have been making in specialized cloud software applications to execute and deliver our services, including our RMM (remote monitoring and management) application and our PSA (professional services automation) tools, tTech was able to execute a quick operational pivot to enable all of our team members to operate from home. We believe that the combination of our strong balance sheet, our particular service offerings and ability to be flexible in our operational modality will enable us to come through any worst‐case scenarios resulting from COVID‐19.”

The earnings per share (EPS) for the quarter amounted to $0.04 compared to an EPS of $0.01 reported in 2019. The trailing twelve months EPS amounted to $0.27. The number of shares used in our calculations is 106,000,000 units. The Company’s stock price closed the trading period on May 14, 2020 at $3.87.

Balance Sheet Highlights:

As at March 31, 2020, the Company reported total assets of $313.08 million, a 24% increase when compared to $253.03 million in 2019. This was as a result of a 197% increase in ‘Other Receivables’ and ‘Rights of use assets’ to close at $42.62 million (2019: $14.34 million) and $27.62 million (2019: nil).

Shareholders’ Equity, as at March 31, 2020, was $220.89 million compared to $199.95 million for the comparable period of 2019. This resulted in a book value per share of $2.08 compared to $1.89 the prior year.

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein