October 31, 2019

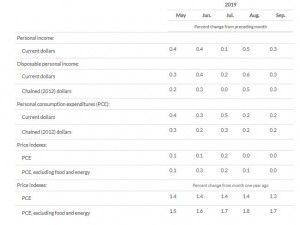

In September, personal income rose $50.2 billion (0.3%) in the U.S, according to estimates released by the Bureau of Economic Analysis. Disposable personal income (DPI) climbed $55.7 billion (0.3%) and personal consumption expenditures (PCE) grew $24.3 billion (0.2%).

Real DPI rose 0.3% in September and Real PCE climbed 0.2%. The PCE price index fell 0.1%. The PCE price index less food and energy increased less than 0.1%.

The growth in personal income in September was primarily attributable to increases in personal interest income, farm proprietors’ income, and government social benefits to persons.

In September, the real PCE rose $22.8 billion which revealed a $18.4 billion increase in spending for goods and a $6.5 billion increase in spending for services. Within goods, the largest contributor to the increase was spending for new motor vehicles. Within services, spending for health care was the leading contributor to the increase.

Personal outlays improved $23.0 billion in September while personal saving was $1.38 trillion and the personal saving rate, personal saving as a percentage of disposable personal income, was 8.3%.

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.