June 13, 2024

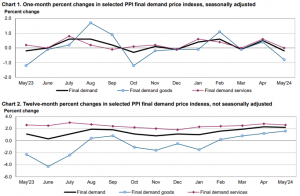

In May, the Producer Price Index (PPI) for final demand decreased by 0.2 percent on a seasonally adjusted basis, according to the U.S. Bureau of Labor Statistics. This follows a 0.5 percent increase in April and a slight 0.1 percent decline in March. Over the 12 months ending in May, the unadjusted final demand index rose by 2.2 percent, indicating an overall upward trend despite the recent monthly decline.

The decline in final demand prices in May was primarily driven by a significant 0.8 percent drop in the index for final demand goods. Meanwhile, the prices for final demand services remained unchanged, providing a stabilizing effect on the overall PPI. This indicates that the fluctuation in goods prices had a more pronounced impact on the overall index compared to services.

When excluding the more volatile categories of foods, energy, and trade services, the index for final demand remained flat in May, after having increased by 0.5 percent in April. For the year ending in May, this core index, which provides a clearer picture of underlying inflation trends by omitting these volatile components, increased by 3.2 percent.

Final demand goods

In May, the prices for final demand goods decreased by 0.8 percent, marking the largest decline since a 1.2 percent drop in October 2023. This decrease was primarily driven by a significant 4.8 percent fall in the index for final demand energy. Additionally, prices for final demand foods edged down slightly by 0.1 percent. However, when excluding the volatile categories of foods and energy, the index for final demand goods rose by 0.3 percent, indicating mixed movements within the broader goods category.

A substantial portion of the May decrease in final demand goods prices—nearly 60 percent—was attributed to a steep 7.1 percent decline in gasoline prices. Other notable declines included diesel fuel, chicken eggs, electric power, jet fuel, and basic organic chemicals. On the other hand, prices for some items, such as cigarettes, which rose by 3.3 percent, as well as hay, hayseeds, oilseeds, and residual fuels, experienced increases, highlighting the diverse pricing dynamics within the goods sector.

Final demand services

In May, prices for final demand services remained unchanged after a 0.6 percent increase in April. Within this category, the index for final demand trade services and the index for final demand services less trade, transportation, and warehousing rose by 0.2 percent and 0.1 percent, respectively. However, these gains were offset by a 1.4 percent decrease in prices for final demand transportation and warehousing services, which contributed to the overall stagnation in service prices.

A closer look at the product details reveals significant variations within the final demand services. Margins for fuels and lubricants retailing surged by 12.2 percent, and there were increases in the indexes for food and alcohol retailing, outpatient care, automobile and automobile parts retailing, and apparel, footwear, and accessories retailing. On the other hand, airline passenger services saw a notable price decline of 4.3 percent. Additionally, prices fell for machinery and vehicle wholesaling, professional and commercial equipment wholesaling, portfolio management, and truck transportation of freight, highlighting the mixed pricing trends within the service sector.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.