August 14, 2025

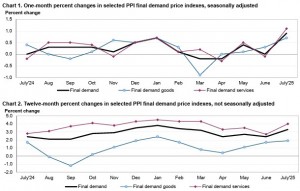

According to the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) for final demand in the U.S. rose by 0.9 percent in July on a seasonally adjusted basis. This follows no change in June and a 0.4 percent increase in May. On an unadjusted basis, the index for final demand advanced 3.3 percent over the 12 months ended July 2025, marking the largest 12-month increase since February 2025.

In July, a 1.1 percent increase in prices for final demand services accounted for more than three-quarters of the overall rise, while prices for final demand goods increased 0.7 percent.

Excluding foods, energy, and trade services, the index for final demand rose 0.6 percent in July, the largest monthly increase since March 2022. Over the past 12 months, this index has advanced 2.8 percent.

Final demand goods

The index for final demand goods rose 0.7 percent in July, matching the largest monthly increase since January. The increase was broad-based, with 40 percent of the rise attributable to a 1.4 percent jump in prices for final demand foods. Prices for goods excluding foods and energy rose 0.4 percent, while energy prices increased 0.9 percent.

Notable contributors to the increase included a 38.9 percent surge in prices for fresh and dry vegetables. Additional gains were observed in prices for meats, diesel fuel, jet fuel, nonferrous scrap, and eggs for fresh use. These increases were partially offset by a 1.8 percent decline in gasoline prices, along with decreases in prices for canned and prepared poultry and plastic resins and materials.

Final demand services

The index for final demand services rose 1.1 percent in July, the largest monthly increase since March 2022. Over half of this increase was driven by a 2.0 percent rise in margins for final demand trade services. Prices for services excluding trade, transportation, and warehousing rose 0.7 percent, while transportation and warehousing services increased 1.0 percent.

Key contributors to the rise included a 3.8 percent increase in margins for machinery and equipment wholesaling, along with gains in portfolio management, securities brokerage and investment services, traveller accommodation services, automobile retailing, and truck transportation of freight. Offsetting these gains were declines in prices for hospital outpatient care (down 0.5 percent), furniture retailing, and pipeline transportation of energy products.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.