January 27, 2022

Gross Domestic Product, Fourth Quarter and Year 2021 (Advance Estimate)

The growth in real GDP was driven mostly by gains in private inventory investment, exports, personal consumption expenditures (PCE), and nonresidential fixed investment, which were somewhat offset by losses in federal, state, and local government spending. Imports increased, which is a subtraction in the computation of GDP.

COVID-19 Impact on the Fourth-Quarter 2021 GDP Estimate

The fourth-quarter GDP increase reflects the ongoing economic impact of the COVID-19 pandemic. COVID-19 cases resulted in continuous restrictions and disruptions in the operations of businesses in several parts of the country throughout the fourth quarter. As elements of numerous federal programs expired or tapered off, government aid payments in the form of forgivable loans to businesses, grants to state and local governments, and social benefits to households all declined. The full economic impact of the COVID-19 pandemic cannot be measured in the fourth-quarter GDP estimate because the repercussions are often contained in source data and cannot be detected separately.

Retail and wholesale trade industries drove the increase in private inventory investment. Motor vehicle dealers were the largest contributors to retail inventory investment. The increase in exports mirrored increases in both products and services. The surge in goods exports was widespread, with consumer products, industrial supplies and materials, and foods, feeds, and beverages leading the way. Travel was the driving force behind the increase in service exports. The increase in PCE indicated mostly an increase in services, led by health care, recreation, and transportation. The increase in nonresidential fixed investment was mostly due to an increase in intellectual property products, which was partly offset by a decrease in structures.

The decrease in federal government spending was mostly due to a reduction in defense spending on intermediate goods and services. The decrease in state and local government spending reflected decreases in consumer expenditures (driven by state and local government employee compensation, particularly education) and gross investment (led by new educational structures). The increase in imports was mostly due to an increase in goods (led by non-food and non-automotive consumer goods, as well as capital goods).

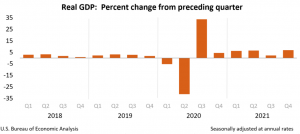

After gaining 2.3% in the third quarter, real GDP increased 6.9% in the fourth quarter. The fourth-quarter acceleration in real GDP was primarily due to an increase in exports, accelerations in private inventory investment and PCE, and smaller falls in residential fixed investment and federal government spending, which were partially offset by a decrease in state and local government spending. Imports have increased.

In the fourth quarter, current dollar GDP increased 14.3% year on year, or $790.1 billion, to a level of $23.99 trillion. GDP increased by 8.4%, or $461.3 billion, in the third quarter.

GDP for 2021

PCE increased as both commodities and services increased. “Other” nondurable items (including games and toys as well as pharmaceuticals), clothing and footwear, and recreational goods and vehicles were the major contributors within goods. Food services and accommodations, as well as health care, were the most significant contributors to services. The increase in nonresidential fixed investment was due to increases in equipment (led by information processing equipment) and intellectual property products (driven by software and research and development), which were somewhat offset by a decrease in structures (widespread across most categories). The increase in exports was due to an increase in products (primarily non-automotive capital goods), which was somewhat offset by a decrease in services (led by travel as well as royalties and license fees). The increase in residential fixed investment was primarily due to the construction of new single-family homes. The increase in private inventory investment was largely due to an increase in wholesale trade (mainly in durable goods industries).

In 2021, current-dollar GDP increased by 10.0%, or $2.10 trillion, to $22.99 trillion, compared to 2.2%, or $478.9 billion, in 2020.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.