July 30, 2025

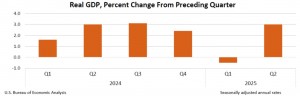

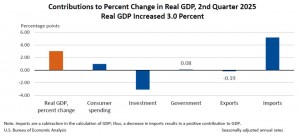

The U.S. economy rebounded sharply in the second quarter of 2025, with real gross domestic product (GDP) increasing at an annual rate of 3.0%, according to the Bureau of Economic Analysis (BEA). This advance estimate marks a strong turnaround from the 0.5% contraction recorded in the first quarter. The improvement surpassed most economists’ expectations and was largely driven by a sharp decline in imports, which significantly boosted net exports. Because imports are subtracted in GDP calculations, the fall in foreign purchases—after a Q1 front-loading surge due to tariff fears—had a positive mechanical impact on Q2 GDP.

Despite the headline strength, the underlying momentum in domestic demand remained soft. Consumer spending, which accounts for more than two-thirds of U.S. economic activity, rose at a modest 1.4% annualized rate, improving from just 0.5% in the previous quarter. However, private domestic investment remained weak, with declines in both residential and equipment investment, while exports also fell slightly. As a result, a key measure of core demand—real final sales to private domestic purchasers—rose only 1.2%, a slowdown from the 1.9% pace seen in Q1. This suggests that while trade distortions helped lift the headline figure, the real economy is not exhibiting robust underlying strength.

Inflation showed signs of easing across several measures. The gross domestic purchases price index increased by 1.9%, down from 3.4% in Q1, signalling slower price growth. Similarly, the Personal Consumption Expenditures (PCE) price index rose 2.1%, a notable drop from 3.7% in the prior quarter. The core PCE index, which strips out volatile food and energy costs and is closely watched by the Federal Reserve, increased by 2.5%, down from 3.5%. These trends indicate that inflation pressures are moderating, although not yet fully aligned with the Fed’s 2% long-term target.

Despite the stronger-than-expected top-line GDP growth, many analysts view the performance as fragile and distorted by trade-related noise. With consumer activity only gradually recovering, business investment still contracting, and exports facing global headwinds, the sustainability of this momentum is questionable. Moreover, the BEA data highlight how tariff-related inventory shifts and trade volatility continue to cloud quarter-to-quarter comparisons, complicating efforts to assess the true health of the economy. Looking ahead, forecasters expect slower growth in the second half of 2025, citing fading fiscal stimulus, tighter credit conditions, and persistent trade uncertainty.

The Federal Reserve is unlikely to change interest rates in the near term, with the current policy rate expected to remain in the 4.25%–4.50% range. With inflation showing signs of cooling but still above the Fed’s preferred level, policymakers are likely to maintain a data-dependent, cautious stance. They will continue monitoring labour market strength, consumer resilience, and inflation trends before considering any rate adjustments. In sum, while the Q2 GDP rebound provides a temporary lift, the underlying economic picture remains mixed, and risks to the outlook remain tilted to the downside.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.