December 23, 2025

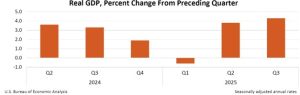

The U.S. economy expanded at a robust pace in the third quarter of 2025, with real gross domestic product (GDP) increasing at an annualized rate of 4.3%, according to the Bureau of Economic Analysis (BEA) initial estimate. This marks a significant acceleration from the revised 3.8% growth in Q2 and exceeded most economists’ expectations, which had projected growth closer to 3.2%. The report reflects a more balanced and broad-based expansion compared to earlier quarters, signalling improved momentum in domestic activity.

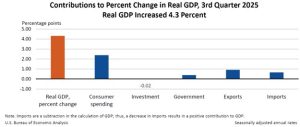

Consumer spending was a key driver of growth, supported by resilient household demand and easing inflationary pressures. Government expenditures also contributed positively, while exports provided an additional lift amid modest improvements in global demand. Private domestic investment showed tentative signs of recovery, contrasting with the weakness observed earlier in the year. These factors combined to deliver the strongest quarterly performance since early 2023, suggesting that the economy is moving beyond the trade-related distortions that characterized the first half of the year.

Corporate profits increased by approximately 4.4%, indicating healthier business conditions and improved margins. While detailed inflation data for Q3 are pending, earlier trends point to continued disinflation, with price pressures moderating across key measures. This dynamic supports the view that the Federal Reserve can maintain its current policy stance without immediate adjustments, as inflation remains above but closer to the 2% target.

Looking ahead, analysts caution that sustainability remains uncertain. Despite the strong headline figure, risks persist from tighter credit conditions, fading fiscal support, and ongoing global trade headwinds. The Federal Reserve is expected to keep its policy rate in the 4.25%–4.50% range, adopting a data-dependent approach as it monitors labour market resilience and inflation trends. While Q3’s performance offers a welcome boost, underlying fundamentals—particularly business investment and external demand—will determine whether this momentum can be maintained into 2026.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.