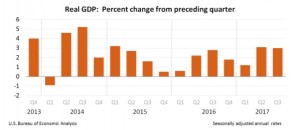

Real gross domestic product (GDP) rose at an annual rate of 3% for the quarter ended September 31, 2017 according to the Bureau of Economic Analysis. GDP had increased 3.1% for the second quarter (see graph below).

The growth recorded in the third quarter resulted from improved contributions from persona consumptions expenditures (PCE), private inventory investment, nonresidential fixed investments, export and federal government spending. According to the Bureau, “these increases were partly offset by negative contributions from residential fixed investment and state and local government spending. Imports, which are a subtractions in the calculation of GDP, decreased.” The increase observed in consumer spending was traced to increases in spending on goods and services. The increase in goods was mostly attributable to motor vehicle, and the increase in services primarily reflected increases in health care, in financial services and insurance, and in food services and accommodations.

The growth in inventory investment resulted from increases in wholesale and in manufacturing inventories. The Bureau of Economic Analysis (BEA) indicated, “the increase in business investment reflected increases in equipment and in intellectual property products; these increases were partly offset by a decrease in structures investment.”

The slowing in the growth rate for the third quarter was associated with, “decelerations in PCE in nonresidential fixed investment, and in exports that were partly offset by an acceleration in private inventory investment and a downturn in imports.”

Prices of goods and services purchased by U.S. residents rose 1.8% within the quarter following a 0.9% growth noticed in prior quarter. The Bureau noted, “food prices increased in the third quarter following a larger increase in the second quarter of 2017. Energy prices increased in the third quarter of 2017 following a decreased in the second quarter of 2017. Excluding food and energy, prices increased 1.7% in the third quarter, compared with an increase of 1.3% in the second quarter of 2017.”

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.