October 4, 2024

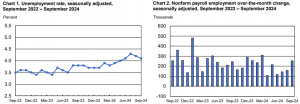

According to the U.S. Bureau of Labor Statistics, total nonfarm payroll employment increased by 254,000 in September, and the unemployment rate changed little at 4.1 percent. Notable, job gains continued its uptrend in food services and drinking places, health care, government, social assistance, and construction. The U.S. Bureau of Labor Statistics reported these findings based on two monthly surveys: the household survey, which assesses labor force status, including unemployment by demographic characteristics, and the establishment survey, which measures nonfarm employment, hours, and earnings by industry.

Household Survey Data

In September, the U.S. labor market showed minimal change in key indicators compared to the previous month. The unemployment rate held steady at 4.1%, with 6.8 million people unemployed, slightly higher than a year earlier. Among demographic groups, adult men saw a decrease to 3.7%, while rates for adult women (3.6%), teenagers (14.3%), Whites (3.6%), Blacks (5.7%), Asians (4.1%), and Hispanics (5.1%) showed little or no change. The number of people unemployed for less than 5 weeks fell by 322,000 to 2.1 million, while the number of long-term unemployed (27 weeks or more) remained unchanged at 1.6 million, up from 1.3 million a year ago, making up 23.7% of all unemployed people.

The labor force participation rate remained stable at 62.7% for the third consecutive month, and the employment-population ratio held at 60.2%. The number of people employed part-time for economic reasons was 4.6 million, an increase from 4.1 million a year earlier. Additionally, 5.7 million people not in the labor force expressed a desire for employment but were not actively seeking work, with 1.6 million marginally attached to the labor force, up by 204,000. Of these, the number of discouraged workers, who believed no jobs were available to them, remained little changed at 445,000.

Establishment Survey Data

In September, total nonfarm payroll employment increased by 254,000, surpassing the prior 12-month average gain of 203,000. Job growth was led by food services and drinking places, which added 69,000 jobs, significantly higher than the 12-month average of 14,000. The health care sector added 45,000 jobs, below its monthly average of 57,000, with notable gains in home health care services (+13,000), hospitals (+12,000), and nursing and residential care facilities (+9,000). Government employment continued its upward trend, adding 31,000 jobs, with growth in local (+16,000) and state (+13,000) governments. Social assistance added 27,000 jobs, primarily in individual and family services (+21,000), while construction added 25,000 jobs, in line with its recent monthly average.

Other major industries, including mining, manufacturing, wholesale trade, retail trade, transportation and warehousing, information, financial activities, and professional and business services, showed little change in employment. Average hourly earnings for all employees on private nonfarm payrolls rose by 0.4%, or 13 cents, to $35.36. For private-sector production and nonsupervisory employees, earnings increased by 0.3%, or 8 cents, to $30.33. The average workweek for all employees edged down by 0.1 hour to 34.2 hours, while in manufacturing, it remained steady at 40.0 hours with a slight decrease in overtime to 2.9 hours.

Revisions to prior months’ employment data showed upward adjustments, with July’s employment revised from +89,000 to +144,000 and August’s from +142,000 to +159,000. These revisions added a total of 72,000 jobs to the previously reported figures for July and August, reflecting additional data from businesses and recalculated seasonal factors.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.