April 19, 2023

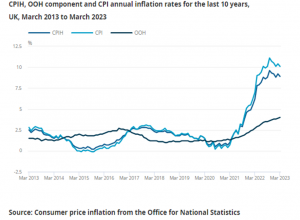

According to England’s Office of National Statistics (ONS) the Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 8.9% as at March 2023 while the Consumer Prices Index (CPI) rose by 10.1%. CPIH & CPI in February 2023 were 9.2% & 10.4% respectively.

The ONS highlighted, “The main drivers of the annual inflation rate for CPIH and CPI are the same where they are common to both measures. However, the owner occupiers’ housing costs (OOH) component accounts for around 16% of the CPIH and is the main driver for differences between the CPIH and CPI inflation rates. This makes CPIH our most comprehensive measure of inflation.”

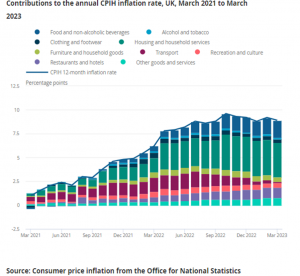

Since March 2023, the largest upward contributions to the annual CPIH inflation rate came from increases in the divisions ‘housing and household services’ (principally from increases in electricity, gas, and other fuels) and increases in food and non-alcoholic beverages. On a monthly basis, CPIH rose by 0.7% in March 2023 compared to an increase of 0.9% in March 2022.

The largest downward contributions to the monthly change in both the CPIH and CPI rates came from motor fuels, and housing and household services (particularly liquid fuels), partially offset by upward contributions from food, and recreation and culture. On a monthly basis, CPI rose by 0.8% in March 2023, in comparison to a 1.1% rise in March 2022.

The CPIH all goods index rose by 12.7% in March 2023, down from 13.4% in February 2023. The slowing rate stemmed from a downward contribution to the change from industrial goods, with overall energy prices rising by 39.7% in the year to March 2023, down from 48.3% in the year to February.

The CPIH all services index rose by 5.7% in March 2023, up from 5.6 in February 2023. The largest upward contribution to the change in the rate between February and March 2023 was from transport services (principally air and rail fares), and package holidays and accommodation. These were partially offset by a downward effect from other recreational and personal services (principally catering services).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.