June 30, 2025

US consumer spending dipped in May, with households curbing discretionary purchases amid concerns about a weaker domestic jobs market, potential tariff-driven spike in inflation and ongoing economic uncertainty.

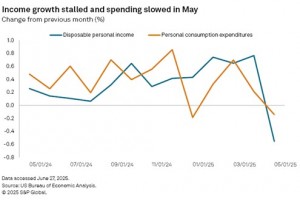

Real consumer spending, adjusted for inflation, fell 0.3% from April, the biggest monthly drop since January, according to a June 27 report from the Bureau of Economic Analysis. The 2.2% year-over-year increase from May 2024 was also the slowest annual growth rate since February. Disposable personal income declined 0.6% from April, marking its first monthly decrease since January 2022.

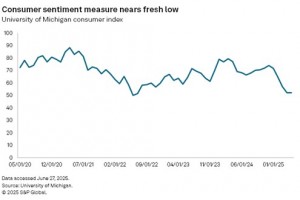

For months, economists observed a disconnect in economic data: inflation generally moderated and unemployment remained low at roughly 4%, while consumer sentiment and economic expectations plummeted. Now, data appears to be catching up with the pessimistic economic signals.

“It’s all of the above,” said Kathy Jones, managing director and chief fixed income strategist for the Schwab Center for Financial Research. “Consumer sentiment readings are quite low on a mix of worries over tariffs raising prices and a softening job market. Consumers are increasingly holding off on making more moves until they see what tariffs, tax policy and immigration restrictions have on the economy.”

The University of Michigan’s consumer sentiment index, released June 27, improved from its near two-year low in May, marking the first increase in six months. However, the survey still indicated expectations of rising inflation and an economic slowdown.

The data follows the bureau’s June 26 revisions to US GDP estimates, which reduced first-quarter consumer spending growth from a 1.2% increase to a mere 0.5%.

“This may be a bit short of a seismic change, but it completely changes the narrative on the health of the consumer and reconciles the head-scratching disparity between plunging confidence and a swaggering consumer unencumbered by tariffs or a weakening labour market,” said Tim Quinlan, a senior economist at Wells Fargo.

Growth in disposable income is stalling, and spending is slowing as US job growth declines and inflation is expected to accelerate. Economists predict these factors will further hinder income and spending growth.

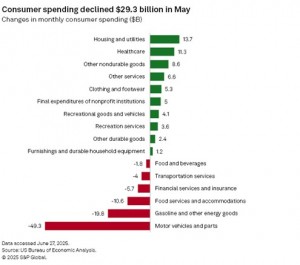

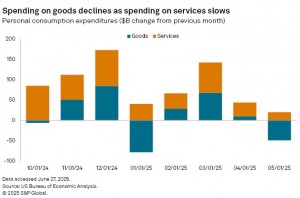

Consumer spending fell $29.3 billion in May, following a combined increase of $252 billion over the prior three months.

Spending on goods dropped about $49.30 billion in May, primarily due to a decline in vehicle purchases. Americans had increased car buying in March and April, anticipating higher tariffs. Meanwhile, spending on services rose by $19.9 billion.

This decline in goods consumption is expected to continue throughout 2025. Economists anticipate Americans will further reduce discretionary spending on areas such as travel, restaurants and gyms.

“The fear of tariffs has caused increased consumer caution, which I think is playing a big role,” said Michael Pearce, deputy chief US economist at Oxford Economics. “More stable trade policy, rate cuts and the coming tax cuts will help drive a revival in spending, though probably not until next year.”

Data suggests the US economy likely cannot absorb higher tariffs without significantly impacting prices, according to Quinlan. While core personal consumption expenditures, the Federal Reserve’s preferred inflation measure excluding volatile food and energy prices, rose just 0.2% from April to May and 2.7% from May 2024, some individual item prices are seeing notable increases.

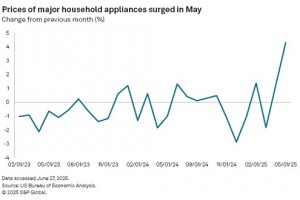

Major household appliance prices in May jumped 4.3% from April, the second-largest monthly gain since the pandemic. The increase in prices for big-ticket purchases could signal that tariffs are already affecting inflation data, Quinlan said.

The spending trend suggests “price fatigue” may be setting in, a condition Quinlan believes could worsen.

“What we’re most focused on, I’d say, is the labour market,” Quinlan said. “We’re expecting just enough of a slowing to warrant rate cuts but not so much of a slowing that you get mass layoffs of the sort that you’d associate with a meaningful drop in wages and salaries.”

Source: (S&P Global Market Intelligence)

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.