November 15, 2023

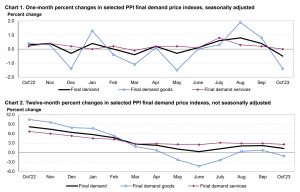

The U.S. Bureau of Labor Statistics released data indicating a 0.5 percent decline in the Producer Price Index (PPI) for final demand in October, following a 0.4 percent increase in September. This marks the most significant decrease in final demand prices since April 2020, reflecting a seasonally adjusted pattern. On an unadjusted basis, the index for final demand showed a 1.3 percent increase over the 12 months ending in October.

The decline in October was largely driven by a substantial 1.4 percent fall in the index for final demand goods, while prices for final demand services remained unchanged during the same period.

Excluding the impact of foods, energy, and trade services, the index for final demand showed a modest 0.1 percent increase in October, marking the fifth consecutive monthly rise. Over the 12 months ending in October, prices for final demand, excluding foods, energy, and trade services, moved up by 2.9 percent, indicating a continued but relatively moderate upward trend.

Final demand goods

In October, prices for final demand goods experienced a notable decline of 1.4 percent, marking the first decrease since a 1.5 percent fall in May. The primary contributor to this decline was the substantial drop of 6.5 percent in the index for final demand energy. Prices for final demand foods also saw a decrease, falling by 0.2 percent. However, the index for final demand goods excluding foods and energy showed a slight increase of 0.1 percent.

A significant portion, over 80 percent, of the October decline in the index for final demand goods was due to a substantial 15.3 percent drop in gasoline prices. Other notable decreases were observed in indexes for diesel fuel, hay, hayseeds, oilseeds, home heating oil, liquefied petroleum gas, and light motor trucks. Conversely, prices for tobacco products increased by 2.4 percent, while indexes for butter and residual fuels also showed upward movement.

Final demand services

In October, prices for final demand services remained unchanged, marking the end of six consecutive months of increases. Notably, there was a 1.5 percent increase in the index for final demand transportation and warehousing services, along with a 0.1 percent rise in prices for final demand services excluding trade, transportation, and warehousing. These increases balanced out a 0.7 percent decline in margins for final demand trade services, where trade indexes measure changes in margins received by wholesalers and retailers.

Within the index for final demand services in October, notable increases were observed in prices for airline passenger services, which rose by 3.1 percent. Additionally, indexes for chemicals and allied products wholesaling, inpatient care, outpatient care (partial), and truck transportation of freight also experienced increases. Conversely, margins for machinery and vehicle wholesaling declined by 2.9 percent. Moreover, decreases were noted in indexes for apparel, footwear, and accessories retailing, portfolio management, traveler accommodation services, and health, beauty, and optical goods retailing.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.