January 27, 2022

Every month the U.S Census Bureau releases an array of statistics pertinent to the economy. For December 2021, the Bureau published statistics for the monthly movement in international trade, wholesale inventories and retail inventories.

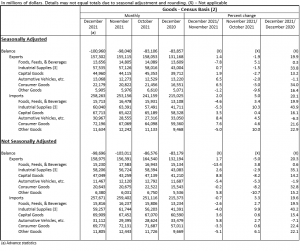

The United States of America’s international trade deficit was $101.0 billion in December, up $2.9 billion from $98.0 billion in November 2021. Exports of goods for December were $157.3 billion, $2.2 billion more than November exports. Imports of goods for December were $258.3 billion, $5.1 billion more than November imports.

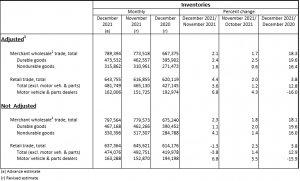

Wholesale inventories for December, adjusted for seasonal variations and trading day differences, but not for price changes, were estimated at an end-of-month level of $789.4 billion, up 2.1 percent (±0.4 percent) from November 2021, and were up 18.3 percent (±1.6 percent) from December 2020. The October 2021 to November 2021 percentage change was revised from up 1.4 percent (±0.4 percent) to up 1.7 percent (±0.4 percent).

Retail inventories for December, adjusted for seasonal variations and trading day differences, but not for price changes, were estimated at an end-of-month level of $643.8 billion, up 4.4 percent (±0.2 percent) from November 2021. These results were up 3.8 percent (±0.9 percent) from December 2020. The October 2021 to November 2021 percentage change was unrevised from the preliminary estimate of up 2.0 percent (±0.2 percent).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.