February 7,2018

Wisynco Group Limited (WISYNCO), for the six months ended December 31, 201, reported total revenue of $12.25 billion for the six months ended December 2017, a 16% or $1.67 billion increase when compared with the $10.59 billion reported for the same period in 2016. Total revenues for the quarter amounted to $6.14 billion reflecting an increase of 15% over the $5.36 billion achieved in the corresponding quarter of the previous year. According to the company, “the quarter in question saw some challenges even as we recorded fairly good growth in top line revenue. We had some of the highest level of rainfall in many years during the quarter which does not auger well for our customers’ businesses as well as beverage sales generally.”

Cost of sales for the period amounted to $7.67 billion, up 13% relative to $6.77 billion reported in 2016. Consequently, gross profit rose 20% to close at $4.58 billion compared to the $3.82 billion for the same period a year earlier.

Total expenses for the six months rose 14% to close at $2.95 billion (2016: $2.59 billion). of total expenses, selling and distribution expenses climbed 13% to total $2.64 billion (2016: $2.33 billion), while administrative expenses increased 23% to $312.442 million (2016: $254.99 million). Total expenses for the second quarter rose 16% to $1.54 billion (2016: $1.33 billion). Other income for the six months contracted 34% to $41.04 million (2016: $61.74 million). According to WISYNCO, “expenses for the quarter included $26 million of costs related to the May 2016 fire and $71 million for the year to date, and the Directors feel these should be fully behind us by the middle of the 4th Quarter.”

As such, WISYNCO booked a 30% increase in operating profit to $1.68 billion (2016: $1.29 billion).

Finance income for the period amounted to $31.22 million, down 71% from the $105.88 million reported for the corresponding period in 2016. Finance costs increased 96% to $144.60 million for the period from $73.65 million for 2016. The company noted, “finance costs for the quarter is a loss on the revaluation of our US$ deposits of approximately $79 million due to the JA$ revaluation to a quarter end rate of 125.00 at the end of December 2017.”

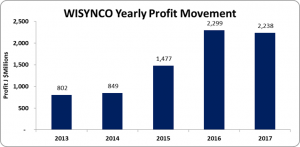

Profit before taxation amounted to $1.56 billion, relative to $1.33 billion reported in 2016, an 18% increase year over year. Taxation for the period amounted to $380.59 million (2016: $227.70 million). Profit from continuing operation amounted to $1.18 billion relative to $1.10 billion booked for the comparable period in 2016. Profit from discontinued operations totalled $41.56 million versus $48.68 million in 2016. As such, net profit of $1.22 billion (2016: $1.15 billion) was posted for the six months ended December 2017, representing a 7% increase year over year. Net profit for the second quarter amounted to $578.01 million relative to $470.05 million in 2016.

Earnings per share (EPS) for the quarter amounted to $0.15 (2016: $0.13), while the EPS for the six months amounted to $0.33 (2016: $0.31). The twelve-month trailing EPS amounted to $0.62. The number of shares used in our calculations is 3,750,000,000. Notably, WISYNCO’s stock price closed the trading period on February 7, 2018 at $10.74.

Balance Sheet at a Glance:

As December 31, 2017, WISYNCO’s assets totalled $13.39 billion, $1.54 billion more than the $11.85 billion recorded last year for the same period. The increase in total assets was largely due to increases in ‘property, plant and equipment’ by $1.37 billion to close at $5.09 billion (2016: $3.72 billion).

Shareholder’s equity closed at $7.84 billion (2016: $6.88 billion). As such, the book value per share was $2.09 (2016: $1.83).

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.