August 19, 2020

Total Revenue for the six months declined 52% to $1.65 billion (2019: $3.41 billion). Of this;

Interest income declined 9% to $10.80 million (2019: $11.89 million)

Net capital loss on financial assets and liabilities amounted to $144.07 million, relative a gain of $68.94 million booked the corresponding period in the prior year.

Hotel Revenue for the six months period decreased by 46% to $1.78 billion (2019: $3.33 billion), the Company noted that, “the outbreak of COVID-19 globally led to a pause in business activities at our local hotel, Jewel Grande Montego Bay (JGM) and those owned by Playa Hotels & Resorts N.V. (Playa) since mid-March. JGM resumed full operations on July 1st while Playa began re-opening on a phased basis. The reopening of the tourism sector has improved the outlook for our business activities.”

Notably, the Company also booked other income of $514,000 (2019: nil).

Operating Expenses for the period decreased 27% to $2.29 billion (2019: $3.15 billion). Of this; interest expense rose 8% to $381.65 million (2019: $352.64 million). Hotel expenses, however, decreased by 39% to $1.44 billion (2019: $2.38 billion). While depreciation increased 20% to $425.56 million (2019: $353.71 million) and Other operating expenses decreased by 40% to $36.80 million (2019: $61.64 million).

As a result, operating loss amounted to $634.26 million, relative to a profit of $264.35 million in the previous comparable period.

Share of loss from associate accounted for using the equity method for the period amounted to $1.93 billion relative to a profit of $878.56 million booked the prior year. Also, the Company reported a loss impairment of investment in associate of $5.20 billion (2019: nil) and a loss from dilution of associate of $380.75 million (2019: nil). Management noted, “with uncertainty surrounding patrons’ confidence in leisure and travel activities, a non-cash impairment charge of $5.20 billion was recorded on our investment in associated company, Playa. On June 12, 2020, Playa announced the issue of 4.88 million ordinary shares priced at U$4.10 per share and additional debt financing of US$204 million. This transaction led to a 0.56% reduction in X-Fund’s holdings and the Group recorded a loss on dilution of $0.38 billion. The shareholders of X-Fund Group have recorded $3.40 billion in relation to the impairment charge and the dilution of interest.”

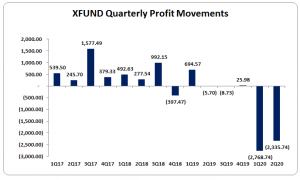

The Company reported a loss before tax of $8.14 billion relative to pretax of $1.14 billion profit booked for the six months ended June 2019. After incurring tax credit of $97.16 million (2019: charge of $109.73 million), Net Loss amounted to $8.05 billion, relative to a profit of $1.03 billion for the comparable period in 2019. However, for the second quarter, Net loss totalled $3.57 billion relative to a profit of $2.76 million booked in 2019.

Net loss attributable to shareholders amounted $5.10 billion, relative to a profit of $688.87 million for the comparable period in 2019. However, for the second quarter, net loss attributable to shareholders closed at $2.34 billion (2019: $5.70 million).

The loss per share (LPS) for the six months closed at $2.28 (2019 EPS: $0.31), While, the loss per share for the quarter amounted at $1.041 (2019 LPS: $0.003). The trailing twelve-month LPS is $2.60. The number of shares used in our calculations was 2,243,005,125. As at August 18, 2020, the stock traded at $7.75.

Balance Sheet Highlights:

The Company, as at June 30, 2020, recorded total assets of $43 billion, decrease of 16% when compared to $51.07 billion recorded in the prior year. This decrease was due to a 26% decrease in ‘Investment in Associate’ to 21.67 billion ($2019: $29.48 billion).

Total Stockholders’ equity as at June 30, 2020 closed at $30.21 billion, a 21% decrease from the $38.05 billion for the corresponding period last year. This resulted in a book value of $13.47 (2019: $16.96).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.