Net International Reserves

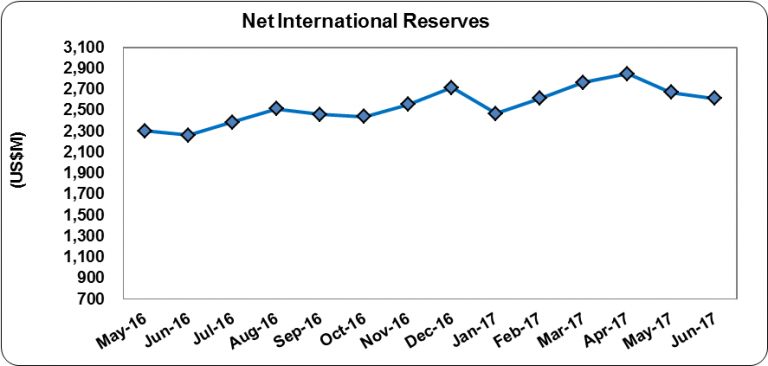

Jamaica’s Net International Reserves totaled US$2,616.81 million as at June 2017, reflecting an decrease of US$55.96 million relative to the US$2,672.77 million reported as at the end of May 2017 (see figure 1).

Changes in the NIR resulted from a decrease in Foreign Assets of US$53.07 million to total US$3,185.65 million. Currency and Deposits contributed the most to the decline in Foreign Assets. This as Currency and Deposits as at June 2017 totaled US$2,880.89 million reflecting a decline of US$54.47 million compared to US$2,935.37 million booked as at May 2017. Foreign Liabilities for June 2017 reflected an increase of US$2.89 million to total US$568.84 million. The increase stemmed from a growth in liabilities to the ‘IMF’ of US$2.89 million. Liabilities to the IMF which accounted for 100% of total foreign liabilities, it increased to a total of US$568.84 million as at the end of June 2017 relative to US$565.95 million recorded in May 2017.

At its current value, the NIR is US$351.68 million more than its total of US$2,265.13 million at the end of June 2016.

The current reserve is able to support approximately 35.44 weeks of goods imports or 20.54 weeks of goods and services imports.

The country surpassed the benchmark of US$2.56 billion outlined by the International Monetary Fund in the 14th Review and Adjusted Agreement under the Extended Fund Facility (EFF). Jamaica and the IMF have entered into a New Agreement to support growth and create jobs with the international body citing, “Jamaica has made good progress under the previous IMF – support program.” As such the entity has approved a new US$1.64 billion loan for the country. According to the IMF the loan is, “intended as insurance to support the country’s ongoing reform program to tackle poverty, create jobs, and improve living standards.” As such the Net International Reserve (NIR) target outlined as per the new agreement for the 2017/18 fiscal year is US$3.02 billion (see figure 2 above).