October 29, 2019

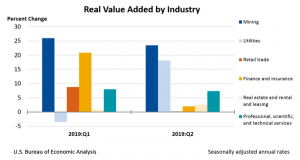

The leading contributors to the uptick in U.S. economic growth in the second quarter of 2019 were professional, scientific, and technical services; real estate and rental and leasing; and mining. According to The U.S. Bureau of Economic Analysis (BEA), “14 of 22 industry groups contributed to the 2.0% increase in real GDP in the second quarter.”

For the professional, scientific, and technical services industry group, a 7.4% advance was realized in the second quarter, after increasing 8.0% in the first quarter. In addition, real estate and rental and leasing increased 2.6 %, after rising 0.80% in the previous quarter. Specifically, increases were realized in other real estate, which includes offices of real estate agents and brokers. Mining hiked 23.5%, after climbing 26.0%. The second quarter growth primarily reflected a rise in oil and gas extraction.

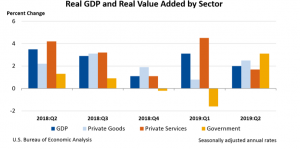

The BEA also noted, “Real GDP growth slowed to 2.0% in the second quarter, from 3.1% in the first quarter. Finance and insurance was the leading contributor to the deceleration with real value added for the industry group increasing 2.0% in the second quarter, after increasing 20.9% in the first quarter.”

There was a 0.2% increase in Retail trade, after increasing 8.8%, and was the second leading contributor to the slowdown. The deceleration was primarily attributed to a slowdown in in other retail, which includes gasoline stations as well as building material and garden equipment and supplies dealers. Utilities climbed 18.1%, after declining 3.5% in the first quarter.

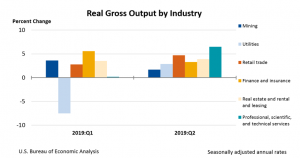

Gross output by industry

In the second quarter, economy-wide, real gross output rose 2.0%. This reflected an increase of 2.9% for the private goods-producing sector, 4.4% for the government sector, while the private goods-producing sector decreased 1.4%. Overall, 15 of 22 industry groups contributed to the rise in real gross output.

https://www.bea.gov/news/2019/gross-domestic-product-industry-second-quarter-2019