1834 Investments Limited (1834)

For the three months ended June 30, 2017

- Revenue for the first quarter of the 2017 financial year declined by 31% to $11.15 million (2016: $16.22 million).

- Other operating income increased significantly in the first quarter of 2017 to $74.54 million. This compares to the prior year’s period figure of $16.94 million representing an increase of 340%. Other income of 74.54 million is mainly due to the sale of a building in Canada $12 million and the sale of shares in RJR communications Group $57 million which were held by the Gleaner Company Limited Employees Investment Trust.

- As a result, total revenues increased by 158% to $85.69 million for the 3 month period in review. This compares to the prior year’s amount of $33.16 million.

- The company had a 92% year on year increase in total expenses. This was attributed to a 1350% increase in other expenses to $18.17 million (2016: $1.25 million), while administration expenses declined 70% to total $2.96 million relative to $9.73 million booked in 2016.

- Consequently, profit from operations for the first quarter of 2016 increased to $64.55 million from the prior year’s figure of $22.18 million representing a 191% increase.

- There was a 50% decline in finance costs in the first quarter of 2017 to $479,000 from $953,000 in 2016. There was a share profit from interest in associate, net of tax of $2.51 million in the first quarter of 2017. This compares to the prior year’s share of profit from interest in associate, net of tax of $35.13 million.

- Consequently, profit from continuing operations before taxation amounted to $66.58 million for the first quarter of 2017 relative to $56.36 million recorded for the corresponding period in 2016.

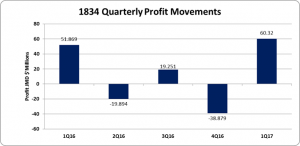

- Taxation of $6.26 million was charged relative to $4.49 reported in 2016. Following this, 1834 booked first quarter profit of $60.32 million relative to $51.87 reported in 2016 a 16% increase year over year.

- The company reported other comprehensive loss for the period of $79.65 million which resulted in Total Comprehensive Loss of $19.33 million for the quarter compared to Total Comprehensive Income of $58.09 million in the similar period last year.

- The earnings per share for the three month period amounted to $0.0498 versus $0.0428. The twelve months trailing loss per share is $0.017, and the number of shares used in this calculation was 1,211,243,827 units.

Balance Sheet Highlights:

- The company, as at June 30, 2017, recorded total assets of $1.75 billion, a decrease of 21% when compared to $2.22 billion as at June 30, 2016.The company saw an increase in investment properties from (2016:nil) to $569.24 million in the period. The decline in assets reported was mainly due to the 96% decline in Long term receivables to total $32.06 million relative to $812.75 million last year.

- Total Stockholders’ equity as at June 30, 2017 closed at $1.67 billion, down 11% from $1.87 billion last year. This resulted in a book value of $1.37 compared to $1.55 billion as at June 30, 2016.