Date: February 13, 2019

Sweet River Abattoir & Supplies Company Limited (SRA) for the nine months ended December 31, 2018: recorded a 17% decline in revenue to $198.51 million relative to $239.43 million in the same period in 2017. Revenue for the quarter went down 14% to close at $63.94 million relative to $73.98 million. SRA indicated, “this decrease was due to the company’s inability to procure pigs from farmers based on its indebtedness to farmers and their unwillingness to continue to supply.”

According to SRA, “the pig industry remains a viable business option in Jamaica as there is a potential market of over 7.0 million to include Jamaicans and visitors to the island. The key stakeholders in the industry should work to prevent the cycle of gluts and shortages thus making their businesses more sustainable.”

Cost of sales fell 18% from $195.35 million in 2017 to $160.67 million in 2018. As a result, gross profit decreased to $37.84 million, a 14% decline when compared to $44.08 million for the same period of 2017. SRA reported that the decline was, “mainly due to the continued reduction in supplies from farmers and the ongoing contract with a third party to supply our min customer at a smaller markup .” Gross profit for the quarter amounted to $17.57 million compared to $11.83 million reported in 2017.

Administrative expenses reported an increase of 17% from $34.38 million for the nine months ended December 31, 2017 to $40.38 million in the corresponding quarter of 2018. The movement was due to, “higher operating cost at the factory and debt servicing.”

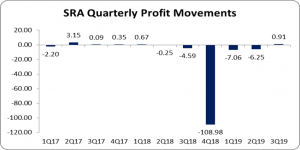

Consequently, SRA recorded operating loss for the period of $2.54 million relative to operating profit of $9.70 million booked for the prior year. Operating profit for the third quarter amounted to $2.82 million versus $226,568 booked for the corresponding quarter of 2017.

Finance costs closed the period at $9.87 million, a decrease of 29% when compared to $13.87 million for the corresponding period last year, while finance income totalled $15,904 (2017: $637).

Furthermore, loss before taxation amounted to $12.39 million versus profits of $4.17 million in 2017. Loss before taxation for the quarter totalled $912,882 compared to a loss of $4.59 million recorded for the same quarter of 2017.

As a result, SRA recorded a net loss of $12.39 million for the nine months ended December 31, 2018 relative to a loss of $4.17 in 2017. The company booked a loss for the quarter of $912,882 million relative to losses of $4.59 million for the comparable quarter in 2017. Management noted, “such performance signals a turnaround after several months of losses during the financial year and come at the start of the winter tourist season as well as the biggest local public holiday a period of celebration described as the “ham season”. The winter tourist season which runs from December to April and more positive performances are expected for the period.”

SRA noted, “the highlights for the quarter are the continued growth of our slaughtering services as well as the maintenance of our primary markets. All of our customers as well as the end users are very pleased with the quality of the products leaving our plant. Our task therefore, is to increase efficiency and productivity while growing our market shares to remain viable. The transitional process has begun and will take about three to six months to be completed.”

The loss per share (LPS) for the quarter amounted to $0.011 versus an LPS of $0.056 for the corresponding period last year. The LPS for the period totalled $0.152 compared to an LPS of $0.051 for the similar period of 2017. The twelve months trailing loss per share is $1.49. The number of shares used in this calculation was 81,531,043 units. The stock price last traded on February 13, 2019 at $3.50.

Balance Sheet Highlights:

As at December 31, 2018, SRA recorded total assets of $410.96 million, a decrease of 7% when compared to $444.17 million for the 2017 quarter one period. The decline in the total asset base was attributed to Property, Plant and Equipment which dipped 16% to $323.47 million (2017: $386.16 million) along with a $1.41 million decrease in ‘Cash and Cash Equivalents’ which ended the period at $10.58 million (2017: $11.99 million).

Total stockholders’ equity as at December 31, 2018 closed at $36.77 million, down 77% from $158.14 million last year. This resulted in a book value of $0.45 compared to a 2017 value of $1.94 a year earlier.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.