Date: August 14, 2019

Radio Jamaica Limited (RJR), revenue for the first three months ended June 30, 2019, increased by 1% from $1.35 billion in 2018 to $1.36 billion. RJR stated, “this was largely due to the performance of the Print and TV segments of the business.”

Direct expenses increased to $659.32 million, this compares to the prior year’s figure of $749.61 million, representing a decrease of 12%. Management noted, “this was mainly due to the non-recurrence of rights and technical fees associated with the 2018 FIFA World Cup project.”

As such, gross profit amounted to $699.58 million relative to $597.44 million for the corresponding period in 2018.

Operating costs increased slightly for the period under review by 2% from $668.32 million in 2018 to $678.90 million in 2019. There was a 1% increase in selling expenses to $199.19 million (2018: $197.29 million), and a marginal decline in administrative expenses to $290.78 million (2018: $290.86 million). RJR noted, “the increases were flat despite inflationary effects, as well as, contracted and union-negotiated salary increases.” Other operating expenses rose 5% to $188.92 million relative to $180.16 million in 2018. The Company mentioned that, “this was due mainly to higher utility costs.”

Other income climbed for the period to $26.87 million compared to the 2018 figure of $22.36 million. RJR mentioned that, “the increase was mainly driven by exchange rate revaluation.”

Operating profit closed the period in review at $47.55 million versus operating loss of $48.52 million in 2018.

Finance costs decreased 31% year on year to $11.67 million when compared to the corresponding period in 2018 figure of $16.87 million.

Profit before taxation closed the three months at $35.87 million relative to loss before taxation of $65.39 million documented in the previous comparable period.

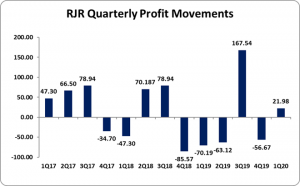

Tax expenses surged to $11.46 million in 2019 from $4.80 million incurred in 2018, which resulted in net profit for the period closing at $24.42 million relative to a loss of $70.19 million for the prior year’s corresponding period in 2018. Net profit attributable to shareholders amounted to $21.98 million versus net loss attributable to shareholders of $70.28 million booked in the same period last year.

The earnings per share (EPS) for the three-month period amounted to $0.009 versus a loss per share of $0.029 in 2018. The twelve months trailing earnings per share is $0.029. The number of shares used in this calculation was 2,422,487,654 units. RJR stock last traded on August 14, 2019 at $1.36.

In addition, the Company stated that, “during the quarter, an integrated broadcasting division was implemented and a more focused approach to technology initiatives and strategic projects across the brand portfolios. The continued roll out of its High Definition workflow resulted in some benefits during the period, even as we await a policy decision from the Government on the technical standard and business model used in Digital Switch Over.”

Balance Sheet Highlights:

The Company, as at June 30, 2019 recorded total assets of $3.83 billion, a marginal decrease of 0.1% when compared to $3.83 billion for the previous corresponding period.

Total Stockholders’ equity as at June 30, 2019 closed at $2.37 billion, went up 2% from $2.33 billion last year. This resulted in a book value of $0.98 compared to a 2018 value of $0.96.

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.