June 24, 2021

The seasonally adjusted initial claims, advance estimate, decreased by 7,000 to 411,000, for the week ended June 19, from the prior week’s revised level of 418,000 from 412,000, up by 6,000, according to the U.S. Department of Labour (DOL). In comparison to the previous week’s average, the 4-week moving average was 397,750, an increase of 1,500. Moreover, the preceding week’s revised average rose by 1,250 from 396,250 to 395,000.

The advance seasonally adjusted insured unemployment rate decreased 0.1 percentage points to 2.4% for the week ending June 12 from the prior week’s unrevised rate. Moreover, DOL stated that, “the advance number for seasonally adjusted insured unemployment during the week ending June 12 was 3,390,000, a decrease of 144,000 from the previous week’s revised level. This is the lowest level for insured unemployment since March 21, 2020 when it was 3,094,000. The previous week’s level was revised up 16,000 from 3,518,000 to 3,534,000.” Relative to last week’s revised average, the 4-week moving average decreased by 55,250 to 3,552,500. The prior week’s average was revised up by 4,000 from 3,603,750 to 3,607,750.

UNADJUSTED DATA

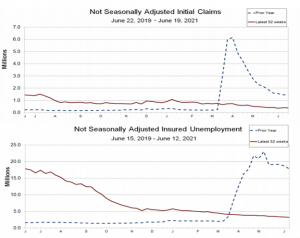

Based on the unadjusted advance estimate, there were 393,078 actual initial claims under state programs in the week ended June 19, a decrease of 14,720 (or -3.6%) from the previous week. The seasonal factors anticipated a decrease of 7,823 (or -1.9%) from the previous week. Furthermore, for the week ended June 19, 51 states observed 104,682 initial claims for Pandemic Unemployment Assistance.

During the week ended June 12, the advance unadjusted insured unemployment rate stood at 2.3% a decrease of 0.1 percentage point compared to the previous week. The advance unadjusted level of insured unemployment in state programs totaled 3,210,285, a decrease of 94,092 (or -2.8%) from a week earlier. The seasonal factors had anticipated an increase of 50,364 (or 1.5%) from the previous week.

A total of 14,845,450 persons claimed benefits in all programs for the week ended June 5, an increase of 3,756 compared to the prior week.

Extended Benefits, during the week ended June 5, were accessible in the following 12 states: Alaska, California, Colorado, Connecticut, District of Columbia, Illinois, Massachusetts, Nevada, New Jersey, New York, Rhode Island, and Texas.

For the week ended the 12th of June, 905 former Federal civilian employees claimed for UI benefits, an increase of 292 relative to the previous week, whereas 569 newly discharged veterans (+141) claimed for benefits.

However, for the week ended the 5th of June 5, 10,764 former Federal civilian employees claimed for UI benefits, a fall of 276 relative to the previous week, whereas 6,554 newly discharged veterans (+205) claimed for benefits.

DOL noted that, “during the week ending June 5, 51 states reported 5,950,167 continued weekly claims for Pandemic Unemployment Assistance benefits and 51 states reported 5,273,180 continued claims for Pandemic Emergency Unemployment Compensation benefits.”

In the week ended June 8, Virgin Islands observed the highest insured unemployment rate of 19.5% followed by Rhode Island (4.8), Nevada (4.5), California (3.9), Connecticut (3.9), Puerto Rico (3.9), Alaska (3.7), Illinois (3.6), New York (3.6), and District of Columbia (3.2).

Pennsylvania (+21,905), California (+15,131), Kentucky (+9,172), Florida (+3,344), and Texas (+3,127) had the highest increases in initial claims for the week ended June12, while Michigan (-5,615), Delaware (-2,516), Washington (-1,998), Tennessee (-1,746), and Alabama (-1,706). had the largest decreases.

Analyst Certification –The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure –The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.