August 12, 2021

IronRock Insurance Company Limited (ROC), for the six months ended June 30, 2021 posted gross written premium of $411.14 million relative $421.98 million; this represents a 3% decrease year over year. For the second quarter gross written premium declined by 13% to total $212.49 million compared to $243.31 million in 2020. Management noted, “During the quarter, we saw renewed price competition in the Property insurance market, despite the growing cost of reinsurance in the region. This has hampered our growth efforts, and left Gross written premium below what was recorded in 2020.”

Proportional reinsurance amounted to $301.61 million compared to $309.91 million in 2020, while excess of loss reinsurance closed the period at $26.91 million (2020: $22.13 million), 22% up from the prior year’s corresponding period.

As a result, net written premium amounted to $82.62 million relative to $89.95 million in 2020, a 8% decrease while for the quarter, net written premium went up by 4% to close at $39.78 million (2020: $38.08 million).

Net earned premium amounted to $93.51 million (2020: $97.83 million) with net earned premium adjustment of $10.89 million (2020: $7.89 million). During the quarter net earned premium amounted to 45.02 million (2020: $47.04 million), after earned premium adjustment of $5.23 million (2020: $8.96 million).

Commission expense totalled $50.72 million in contrast to $43.96 million in 2020, while commission income grew by 28% from $45.89 million in 2020 to total $58.52 million for the period under review.

Net claims declined by 17% from $50.88 million to $42.31 million for the six months ended June 30, 2021. In addition, operating expenses went down by 4% to $90.26 million (2020: $94.30 million). As such, underwriting loss for the period amounted to $31.25 million relative to a loss of $45.41 million a year earlier. Underwriting loss for the quarter amounted to $20.33 million compared to the $22.35 million reported in 2020.

ROC recorded $28.45 million for total other income, relative to $27.80 million booked for the six months ended June 2020. Of this;

- Investment income amounted to $20.53 million relative to $21.26 million in June 2020.

- Foreign exchange gain amounted to $6.83 million versus $4.99 million in June 2020.

- Gain on sale of investment amounted to $1.08 million versus $1.52 million in June 2020

- Miscellaneous income amounted to $9,000 versus 29,000 booked June 2020.

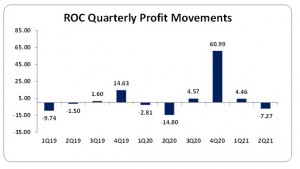

As a result, the company recorded a loss before taxes of $2.81 million compared to a loss of $17.61 million the prior period, while loss for the quarter totalled $7.27 million relative to the loss of $14.80 million for the comparable quarter in 2020. Since there was no taxation recorded for the period, net loss equals pre-tax loss for both the quarter and six months period.

Loss per share accumulated to $0.01 (2020 LPS: $0.08), while for the quarter, LPS amounted to $0.03 (2020 LPS: $0.07). The trailing twelve months loss per share amounted to $0.29. The stock price as at August 11, 2021 was $3.02. The numbers of shares used in the calculations are 214,000,000.00 units.

ROC stated, “marketing for our “Pay as You Drive” (or “PAYD”) Telematics motor insurance product has generated more awareness of the IronRock brand, and increased interest in all of our motor insurance products. This has driven a 40% increase in premium generated by our direct motor insurance portfolio for the quarter, and is a promising sign that the local motor insurance market is keen to see further innovation.”

Furthermore, “for the remainder of the year, our focus will be on meeting our growth targets, while maintaining a disciplined underwriting approach. Expense control remains a top priority, and we are focused on generating higher returns from our investment portfolio as local and global economic conditions improve,” according to ROC.

Balance Sheet Highlights:

As at June 30, 2021, ROC’s assets totalled $1.56 billion (2020: $1.47 billion), 6% greater than the amount booked during 2020. ‘Investments’ contributed to the increase in the asset base closing the period at $708.57 million (2020: $539.26 million), reflecting a 31% increase year over year. The movement as however offset by ‘Insurance and other Receivables’ which closed at $186.25 million (2020: $294.04 million).

Shareholder’s equity closed at $573.15 million (2020: $495.84 million) which resulted in a book value per share of $2.68 (2020: $2.32).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein