April 29, 2025

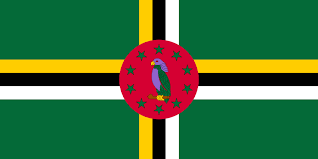

The World Bank’s board of executive directors has approved a $24 million Development Policy Credit to support the Commonwealth of Dominica. This funding aims to strengthen domestic revenue mobilization, enhance financial sector resilience, and promote biodiversity conservation and disaster preparedness, ultimately providing better opportunities for Dominica’s people.

Dominica, often referred to as the “Nature Island of the Caribbean,” boasts exceptional biodiversity and marine ecosystems that are crucial to its tourism-dependent economy. However, the country has faced significant setbacks due to natural disasters and climate-related shocks. Tropical Storm Erika in 2015 and Hurricane Maria in 2017 caused extensive damage, and while Dominica was spared the worst of Hurricane Beryl in July 2024, the storm still inflicted infrastructural damage and disrupted livelihoods. These events have severely weakened the country’s public finances and financial system, with public debt peaking at 118.2 percent of GDP in 2020 and remaining high at 103 percent in 2024.

In response to these challenges, the Dominica Strengthening Fiscal and Climate Resilience Programmatic Development Policy Credit was developed to support the country’s reform agenda. The operation backs a series of policy measures aimed at advancing key economic and climate resilience reforms. This includes reforming excise taxes on goods such as fuel, alcohol, and sugary drinks, which can have harmful effects on health or the environment. These reforms are expected to boost revenue, reduce greenhouse gas emissions, and improve public health outcomes. Additionally, the operation strengthens financial oversight of key institutions like the Dominica Agricultural Industrial and Development Bank and credit unions, enhancing overall financial sector stability.

The initiative also focuses on safeguarding Dominica’s marine ecosystems and increasing climate resilience. Notably, it includes the establishment of the world’s first marine protected area dedicated to sperm whales. Revenue from swim-with-the-whales permits is projected to rise by 177 percent by 2027, supporting conservation, livelihoods, and eco-tourism. Furthermore, the government is adopting a new risk-based asset management system for public buildings to enhance disaster preparedness and guide investment in resilient infrastructure. By 2027, 40 percent of public fixed assets are expected to be inventoried and prioritized for risk mitigation, improving Dominica’s capacity to respond to future climate shocks.

Aligned with Dominica’s National Resilience Development Strategy 2030 and the Climate Resilience and Recovery Plan 2020–2030, the program was designed through extensive consultation with national stakeholders and development partners, including the Caribbean Development Bank and the International Monetary Fund. Funding is provided by the International Development Association, the World Bank Group’s arm that supports low-income countries and small island economies.

Source: (Caribbean News Global)

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.