April 22, 2021

For the six months ended March 31, 2021, Barita Investments Limited (BIL) net interest income increased by 37% amounting to $740.64 million relative to $540.08 million for the comparable six months in 2020. “The rise in reflects continued growth in the Group’s asset base resulting from the deployment of our increased capital position into credit growth in the Group’s asset base resulting from the deployment of our increased capital position into credit and fixed income assets coupled with a 63% YoY rise in repo liabilities,” as per Barita. Net interest income for the second quarter closed at $373.27 million (2020: $331.46 million).

Dividend Income fell 85% to total $629,000 compared to the $4.33 million earned for the six months ended March 31, 2020. Gains on investment activities fell by 7% to $790.81 million (2020: $851.12 million). BIL noted, “this business segment relates to managing our proprietary trading portfolio. The decline YoY is attributable to the reduced trading activity experienced during Q2 FY21 versus the comparable period in FY20. This decline in trading activity experienced during Q2FY21 versus the comparable period in FY20. This decline in trading activity is related to the general trends in global fixed income markets during Q2, largely characterized by rising interest rates, which negatively affected fixed income portfolios.”

Fees & Commissions Income rose significantly by 79% to close at $1.36 billion (2020: $760.41 million). Management noted, “the rise in fee income during the period is attributable to an increase in fees generated by investment banking and asset management business lines relative to the corresponding period in FY20. During Q2 FY21, Barita completed several capital markets deals including the landmark Additional Public Offering (“APO”) for Derrimon Trading Company (“DTL”), which was the largest fundraise in the history of the Junior Market of Jamaica Stock Exchange attracting more than $7 billion in subscriptions.”

Foreign exchange trading and translation gain amounted to $1.14 billion compared to a gain of $106.64 million recorded in the previous year. Management indicated, “we continue to actively manage the Group’s balance sheet foreign exchange exposure in our effort to safeguard shareholder’s equity against trading operations through a combination of greater customer engagement and increased transactional activity. The local currency (J$) local currency showed a depreciatory tend for Q2 FY21, closing March 2021 against the United States Dollar (“US$) at J$146.58: US$100, a devaluation of $3.83 or 2.7% versus the December 2020 level.

Other income totalled $13.58 million versus $2.35 million recorded for the similar period in 2020. As such, net operating revenue amounted to $4.05 billion relative to $2.26 billion recorded for the comparable period in 2020. Net operating revenue for the quarter rose 81% to $2.05 billion relative to $1.13 billion.

Administrative Expenses for the period amounted to $779.40 million, increasing 50% from $518.91 million in 2020. Staff costs for the six months rose 72% from $345.33 million booked in 2020 to $592.69 million in 2021. ‘Impairment/ Expected Credit rose 7% to $101.09 million compared to $94.18 million reported in 2020. Management noted, “the increase in ECL is a function of the significant balance sheet expansion, in particular the increased credit portfolio. The rise in expenses during the quarter reflects the Group’s continued investments in the critical pillars of its transformational growth strategy to include acquisition and retention of human capital management, customer acquisition initiatives, and development of key infrastructure to enhance customer experience.”

Profit before tax amounted to $2.57 billion relative to a profit before taxation of $1.31 billion in 2020. Profit before tax for the quarter improved 89% to $1.26 billion (2020: $665.85 million).

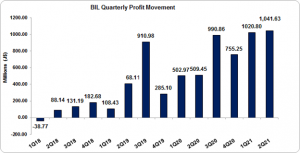

Following taxation of $509.60 million (2020: $294.09 million), the company reported net profit of $2.06 billion, a 104% increase when compared to $1.01 billion documented twelve months earlier. Net profit for the quarter amounted to $1.04 billion (2020: $509.45 million).

Total comprehensive income for the six months ended March 31, 2021 was $1.98 billion relative to $548.34 million in 2020. While for the quarter, total comprehensive income closed at $959.72 million (2020: $297.70 million).

The earnings per share for the six months end March 31, 2021 amounted to $1.90 relative to the EPS of $0.93 reported in 2020. EPS for the quarter amounted to $0.96 (2020: $0.47). The trailing earnings per share amounted to $4.62. The number of shares used in our calculations amounted to 825,003,263 units. BIL stock price closed the trading period on April 22, 2021 at $86 with a corresponding P/E of 18.63 times.

Balance Sheet at a glance:

As at March 31, 2020, total assets amounted $78.49 billion (2020: $48.66 billion), a $29.83 billion improvement year over year. The growth was as a result of ‘Pledged Assets’ which increased by $25.67 billion to a total of $47.18 billion (2020: $21.52 billion) and ‘Loan Receivables’ which rose by $6.19 billion to $7.29 billion (2020: $1.10 billion).

Shareholders’ Equity amounted to $28.66 billion relative to $14.40 billion reported in 2020 resulting in a book value per share of $34.74 relative to $17.45 booked in 2020.

Disclaimer:

Analyst Certification –The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure –The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.