November 15, 2022

For the period ended September 30, 2022, Caribbean Flavours & Fragrances Limited’s (CFF) revenue increased by 21% to $561.94 million relative to $464.19 million for the comparable period in 2021. For the quarter, the Company generated revenue of $202.08 million (2021: $162.89 million), a 24% increase year over year. CFF noted that this increase is, “our highest grossing quarter to date. This increase in revenue came as a result of the company’s continued work in building both local and export sales which are being reflected in these results.”

Cost of sales also increased for the period to $388.56 million, this compares to the prior year’s figure of $314.80 million, representing an increase of 23% year over year. Consequently, gross profit rose to $173.38 million for the period in review and compares to the prior year’s amount of $149.38 million. For the quarter, gross profit closed at $57.59 million (2021: $53.61 million). Management noted, “this can be attributed to the faster than expected price increases in raw materials where some major inputs experienced a sharp spike in base prices before returning to some levels of normalcy later in the quarter.”

The Company had a 14% year over year increase in total expenses to $111.09 million, up from $97.27 million in 2021. Notably, there was a 19% growth in selling & distribution expenses to $3.34 million (2021: $2.82 million). Whereas administrative expense for the period climbed to $107.75 million versus the prior year’s corresponding total of $94.45 million. The movement in expenses was as a result of increases in salaries and wages, increased utility costs and costs associated with the build out of the overseas explorations. CFF further noted, “while these expenses are higher, the company was able to secure a new multibillion-dollar overseas client and we expect to see activities from this new relationship within the next quarter.”

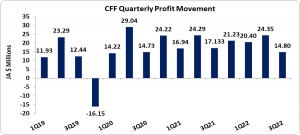

Consequently, Profit from Operations for the period increased to $62.29 million versus $52.12 million booked for the period ended September 30, 2021, while for the quarter, there was a 26% decline from $17.13 million in 2021 to $12.65 million in 2022. The Company reported a 63% decline in net finance income from $14.24 million in 2021 to $5.27 million in 2022.

Following taxation of $8 million (2021: $8 million), net profit for the period amounted to $59.56 million representing a marginal increase from the prior year’s period of $58.36 million, while for the quarter, net profit fell by 14% from $17.13 million in 2021 to $14.80 million in 2022.

The earnings per share for the period months amounted to $0.066 (2021: $0.065), while the EPS for the quarter amounted at $0.016 (2021: $0.019). The twelve months trailing EPS is $0.09. The number of shares used in this calculation was 899,200,330 units. As at November 14, 2022 the stock traded at $1.62 with a corresponding P/E ratio of 18.03 times.

Balance Sheet at a glance:

The Company, as at September 30, 2022, recorded total assets of $765.51 million, an increase of 16% when compared to $659.14 million for the prior year. This increase was as a result of increases in ‘Inventories and ‘Cash and bank balances’ which closed at $210.31 million (2021: $144.34 million) and $47.03 million (2021: $23.57 million), respectively.

Total Stockholders’ equity closed at $584.19 million, an improvement of 16% from $505.11 million last year. This resulted in a book value per share of $0.65 compared to a book value of $0.56 for the last year.

DISCLAIMER:

Analyst Certification – This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.