February 15, 2022

Expressed in Barbados dollars

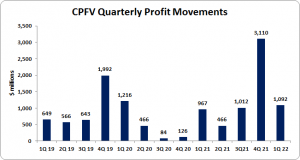

Eppley Caribbean Property Fund Limited (CPFV), for the three months ended December 31, 2021 reported net rental income of $1.10 million (2020: $936,220), a 17% increase year over year. In addition, share of profit of investments accounted for using the equity method decreased from $417,430 in 2020 to $566,122 for the three months ended December 2021.

Interest income amounted to $187,600 versus $201,860 booked for the corresponding three months last year.

As such, total investment income decreased to a total of $1.85 million (2020: $1.56 million).

Total operating expenses amounted to $735,260 (2020: $588,987). Total operating expenses can be broken down as follows:

- Interest expenses totalled $323,374 (2020: $153,333).

- Fund management fees was $187,942 compared to $175,935 booked twelve months earlier.

- Professional fees totalled $89,154 (2020: $76,187).

- Directors and subcommittee fees closed at $840 (2020: $830).

- Office and administrative fees went down to $1,936 (2020: $3,257).

- Investment advisor fees totalled $187,942 (2020: $175,935).

Profit before tax for the three months ended December 31, 2021 closed at $1.11 million (2020: $966,523), whereas net profit amounted to $1.09 million (2020: $966,523), after a taxation expense of $21,534 (2020: nil).

Profit attributable to Cellular property fund shareholders for the three months amounted to $1.09 million compared to $966,523 booked prior corresponding period.

Consequently, total comprehensive loss for the period closed at $113,878 compared to income $966,831 reported for 2020’s corresponding period.

Earnings per share for the three months ended December 31, 2021 totalled 0.7986 cent compared to EPS of 0.7068 cent for the corresponding period in 2020. The twelve months trailing EPS amounted to 4.2941 cents. The total amount of shares outstanding used for this calculation was 136,742,547 units. CPFV closed the trading period at J$41.00 on February 14, 2022 with a corresponding P/E of 12.32 times.

CPFV noted, The Value Fund has been off to a strong start in the new financial year building on the momentum from record profitability last year. As we progress through 2022, we expect to see continued improvements in performance as the global economy opens up and continues its path to gradual recovery. Last year, we significantly enhanced the quality of our portfolio through strategic acquisitions across Jamaica and Trinidad & Tobago. The Fund is well positioned to continue to benefit from inflation protection provided by high-quality commercial real estate that generates strong yielding cash flows.”

Balance sheet at a glance:

As at December 31, 2021, total assets amounted to $125.01 million, 8% more than prior corresponding period’s $116.08 million in 2020. This was attributed to a rise in ‘Investment properties’ which closed the period at $72.95 million (2020: $63.22 million).

CPFV, as at December 31, 2021, booked total shareholders’ funds of $98.34 million (2020: $95.66 million), which translated into a net asset value per share of $0.719 (2020: $0.70).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.