November 10, 2022

Figures are quoted in United States dollars (except where it is indicated otherwise):

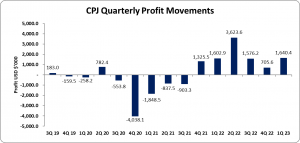

Caribbean Producers Jamaica Limited (CPJ), for the first three months ended September 30, 2022 reported that revenues increased by 32%, to close the period at $33.06 million compared to the $25.02 million for the same period last year.

Cost of operating revenue rose by 35%, closing the period at $22.83 million relative to $16.88 million for the same period last year. Notwithstanding, gross profits grew by 26% to total $10.24 million relative to $8.14 million in 2021.

Selling and distribution expenses were $6.17 million relative to the $4.37 million posted last year. Depreciation for the period fell by 1% closing the period at $1.03 million (2021: $1.04 million).

Other operating income totalled $6,346 compared with the operating loss of $124,479 booked the previous year.

Profit before finance costs, income and taxation totalled $3 million relative to $2.56 million reported in 2021.

Finance costs was $755,378 versus the $683,223 reported in 2021, an 11% increase while finance income fell to $214 (2021: $4,273). Profit before taxation amounted to $2.24 million compared to that of $1.89 million in 2021.

Taxation for the period under review ended at $518,740 (2021: $219,568), consequently, net profit for the period amounted to $1.72 million relative to $1.67 million in 2021.

Net profit attributable to shareholders ended the period at $1.64 million relative to $1.60 million in 2021.

As a result, earning per share for the period amounted to US0.15 cents (2021: US0.15 cents), while the twelve-month trailing EPS totalled US0.686 cents. The number of shares used in our calculations amounted to 1,100,000,000 units. The stock price closed November 9, 2022 at J$12.94 with a corresponding P/E ratio of 12.36 times.

CPJ further noted, “We look forward to the opening of the new CPJ Market Drax Hall and will continue the work of enhancing the food-service product line in our CPJ Markets.”

Balance Sheet at a glance:

As at September 30, 2022, total assets amounted to $86.48 million, 20% more than its value of $72.07 million booked a year ago. This was mainly attributable to a 35% increase in ‘Inventories’ which amounted to $40.37 million (2021: $29.83 million). According to the Company, “As the uncertainties around the availability of goods and the global supply chain persists, CPJ has been proactive as it relates to inventory, as have many companies globally, in order to guarantee uninterrupted service to our customers.”

Shareholder’s Equity as at September 30, 2022, totalled $24.79 million (2021: $17.24 million) resulting in a book value per share of approximately US2.254 cents (2021: US1.568 cents).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.