October 01, 2021

Figures are quoted in United States dollars (except where it is indicated otherwise):

Caribbean Producers Jamaica Limited (CPJ) for the year ended June 30, 2021 reported a 37% decline year on year in gross operating revenues to close at $58.18 million compared to the $91.70 million for the prior year. For the fourth quarter the company posted a 264% increase in revenues to close at $21.07 million relative to $5.78 million for the same quarter of 2020. Additionally, Management highlighted that revenue declined due to “the closure of hotels in March 2020.” Management also noted that, “the Group had projected US$120M in sales for the FY2020 prior to the pandemic.” Additionally, Management highlighted that revenue declined due to “the closure of hotels in March 2020.” Management also noted that, “the Group had projected US$120M in sales for the FY2020 prior to the pandemic.” The Group also noted that, “the improvement in revenue for Q4 was the direct result of an easong in travel restrictions and increase in tourist arrivals, as the vaccination drive in many countries boosted traveller confidence.”

Cost of operating revenue showed a 40% decrease closing the period at $42.46 million relative to $70.93 million for the previous year. For the quarter the company recorded a 134% increase in cost of operating revenue to close at $15.25 million relative to $6.53 million for the comparable period in 2020. Consequently, CPJ recorded a 24% decline in gross profit to $15.71 million (2020: $20.77 million). The quarter incurred a gross profit of $5.81 million relative to a gross loss of $742,770 in 2020.

Selling and administrative expenses were $13.11 million, a 32% decrease from the $19.27 million posted last year. Depreciation for the year was $4.19 million when compared to the corresponding prior year of $4.34 million. Expected Credit losses $74,820 (2020: $443,496).

Other operating income totalled $1.32 million; this compares with other operating income of $128,448 booked a year ago.

Operating loss totalled $335,450 relative to operating loss of $3.15 million in 2020.

Finance income amounted to $33,099 (2020: $3,724), while Finance cost was $2.22 million (2020: $2.41 million). As such, loss before taxation was $2.52 million compared to a loss of $5.55 million in 2020.

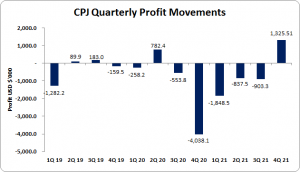

Net loss for the financial year amounted to $2.52 million compared to a net loss of $4.35 million booked in 2020 following tax benefit of $1.20 million in 2020. On the other hand, the Company reported net profit of $1.27 million for the quarter ended June 2021 relative to a net loss of $4.35 million booked last year.

Net loss attributable to shareholders for the year amounted to $2.26 million, this compares with the net loss attributable to shareholders of $4.07 million booked twelve months earlier.

As a result, loss per share (LPS) for the year amounted to US0.2058 cent compared to LPS US0.3698 cent in 2020. EPS for the quarter amounted to US0.12 cent relative to loss per share of US0.39 cent. The number of shares used in our calculations amounted to 1,100,000,000 units. CPJ’s stock price closed the trading period on September 30, 2021 at a price of $4.85.

CPJ’s also stated, “It has been a year and a half since COVID-19 began its unprecedented impact on the global economy. COVID-19 continues to disrupt and dictate global economic activities, especially the travel sector and global supply chain industry. Management expects that challenges will continue in supply chain for the short to medium term. Based on improvements in the dissemination of vaccine in Europe, the US and Canada, our main travel partners, Management is confident that thus points to a strong rebound in tourism.”

CPJ further noted, “The upward trend has continued into the new fiscal year with unaudited July Group revenues of US$9.4M and CPJ Jamaica revenues of US$7.6M. The Company is projecting that this upswing is the result of a pivotal turn in tourism and will be a continuing trend. The Company is closely monitoring and assessing the impact of the new Delta variant of the virus. The Management of CPJ is cautiously optimistic that changes in restrictions will not lead to any further travel bans or closures of hotels, nor in any way impact or slow the recovery of the sector.”

Furthermore, Management of CPJ has “implemented and embraced strategies to mitigate against the risk of COVID-19. One such example is the development of new sales strategies to improve market share in the retail channel, including expanded product lines. A new and improved online store and expansion of the CPJ Market in Montego Bay. Construction of the 6000 sq. foot store started in July and is estimated to open early next year,” CPJ noted.

The Company also highlighted that “Management is committed to continue its pursirt of cost saving initiatives and operational efficiencies through improvements in IT systems relating to supply chain processes, distribution and warehouse management. As part of that commitment and despite the pandemic, the CPK Group invested more than US$1.8M in capital expenditure during FY ending June 2021. Processes and initiatives implemented during the course of the last eighteen months have resulted in a material reduction in costs of operation at CPJ.”

Balance Sheet Highlights:

As at June 30, 2021, CPJ’s total assets amounted to $66.33 million, a 10% increase year over year from the $60.56 million as at June 30, 2020. The increase was due mainly to an increase in ‘Accounts receivables’ which rose 84% to $15.39 million versus $8.39 million reported in 2020. ‘Right of Use’ also contributed to the upward movement in the asset base with a 56% increase to $11.53 million from $7.39 million in 2020.

Shareholder’s Equity as at June 30, 2021 totalled at $15.64 million (2020: $17.91 million) resulting in a book value per share of approximately US1.422 cents (2020: US1.628 cents).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.