Cable & Wireless Jamaica Limited (CWJ)

For the six months ended September 30, 2016

Revenue for the period increased by 9% to $20.03 billion relative to $18.34 billion last year. Revenue for the quarter totalled $6.83 billion a 13% increase year over year (2016: $6.04 billion). “This improvement was driven chiefly by our customers demand for continuous connectivity, mobility, data security and transmission, in addition to our disciplined approach to managing costs.”

Operating costs before depreciation and amortization increased by 5% to $13.10 billion. The Company reports that it was “due to a 5% increase in outpayments and direct costs, primarily a result of an increase in interconnect costs associated, in part, with an increase in mobile and international fixed line activity; and a 4% net increase in employee, administration, marketing and selling expenses driven by higher management and royalty fees.”

Depreciation reduced by 16% to $2.19 billion compared to $2.59 billion in the prior year to date. Amortization increased by 29% to $1.12 billion, up $256 million. For the period, Impairment, Restructuring and Other Operating items, net amounted to loss of $26 million relative to a gain of $1.97 billion reported in 2016.

Consequently, Operating Profit increased by 17% to $3.60 billion relative to $4.34 billion last year. Net finance cost was reported at $4.07 billion relative to $3.52 billion in 2016.

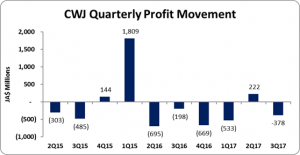

The company reported loss before tax of $470 million relative to profit of $942 million the year prior. Taxation for the period was reported at $218 million relative to $26 million for 2016. This resulted in a Net Loss for the period of $688 million relative to a Net Profit of $916 million the prior year. For the quarter the company reported a loss of $378 million a 91% increase over Net loss of $198 million reported in 2016.

The twelve month earnings-per-share amounted to $0.08 while for the period, there was a loss-per-share of $0.04. The Company had a loss-per-share of $0.02 for the quarter. The amount of shares used in our calculation is 16,817,440. The company closed the at $1.08 as at the end of trading on November 14, 2017.

Balance Sheet Highlights:

The company, as at September 30, 2017, recorded total assets of $42.68 billion.

Total Stockholders’ deficit as at September 30, 2017, closed at $30.58 billion, this resulted in a book value of negative $1.82.