May 17, 2021

Expressed in United States Dollars unless otherwise stated

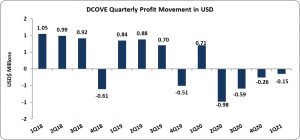

Dolphin Cove (DCOVE), for the three months ended March 31, 2021, reported total revenue of US$739,155, a 78% decrease when compared to US$3.29 million booked the year prior. Revenue from Dolphin Attraction contributed US$373,824 to total revenue; this represents a 79% decline when compared to the US$1.79 million reported in the prior year. Revenues from the Ancillary Services totalled US$365,331, a 76% decrease from last year’s US$1.50 million. According to the Company “The focus of our management has been to set strategies and generate more business but at the same time to ensure that the parks maintain a slim and controlled operation sufficient to provide a high-quality service to our guests and maintaining the well-being of our staff members and the animals under our care. As a result of the measures implemented, the company reached a quarterly operating profit for the second time since we resumed operations. ”

Total direct cost for the first quarter amounted to US$144,190, a 64% decline when compared to the US$405,538 reported in 2020.

As such, gross profit for the quarter went down by 79%, amounting to US$594,965 relative to last year’s total of US$2.88 million.

Other income decreased 29% to US$42,302 relative to US$59,655 booked in 2020.

Total operating expenses fell 59% moving from US$2.15 million in 2020 to US$882,523 as at March 2021. Of this, administrative expenses totalled US$174,689 (2020: US$382,644), while selling expenses amounted to US$219,496 (2020: US$643,192). Other operating expenses for the period fell 57% to US$488,338 (2020: US$1.13 million).

Finance income rose by 60%, totalling US$96,864 relative to US$60,689 last year, while finance cost decreased from US$76,047 for the same period in 2020 to US$31,663 as at March 2021.

Loss before taxation amounted to US$180,255 relative to the profit of US$777,983 booked in the prior comparable period.

Tax credit of US$25,866 was booked for the quarter, relative to taxation expense of US$69,069 in 2020.

Net loss for the quarter was US$154,389, this is compared to net profit of US$708,914 booked the prior year.

Loss per share (LPS) for the three months totalled US$0.0004 relative to earnings per share of US$0.0018 in 2020. The trailing twelve-month LPS amounted to U$0.005. The stock traded at JMD $7.99 as at May 14, 2021. The number of shares used in the calculation was 392,426,376.

Balance sheet highlights

As at March 31, 2021, the Company’s assets totalled US$30.19 million, 7% less than the US$32.39 million reported as at March 31, 2020. This was as a result of a 58% decrease in ‘Accounts receivable’ to US$757,453 (2020: US$1.80 million) and ‘Due from related parties’ to US$911,621 (2020: US$323,367).

DCOVE closed the three months with shareholders’ equity in the amount of US$26.51 million (2020: US$28.51 million) which resulted in book value per share of US$0.073 (2020: US$0.068).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.