Date: October 22, 2018

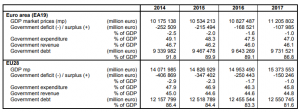

According to Eurostat, “In 2017, the government deficit and debt of both the euro area (EA19) and the EU28 decreased in relative terms compared with 2016.” Furthermore, it was indicated by Eurostat that, “in the euro area the government deficit to GDP ratio fell from 1.6% in 2016 to 1.0% in 2017, and in the EU28 from 1.7% to 1.0%. At the end of 2016, there was a decline from 89.1% in the government debt to GDP ratio, in the euro area, to 86.8% at the end of 2017. While, in the EU28, there was a decline from 83.3% to 81.6%.

Notably, in 2017, government surplus was registered in Malta (+3.5%), Cyprus (+1.8%), Sweden (+1.6%), Czechia (+1.5%), Luxembourg (+1.4%), the Netherlands (+1.2%), Bulgaria and Denmark (both +1.1%), Germany (+1.0%), Croatia (+0.9%), Greece (+0.8%), Lithuania (+0.5%) and Slovenia (+0.1%). However, the lowest government deficits to GDP were recorded in Ireland (-0.2%), Estonia (-0.4%), Latvia (-0.6%) and Finland (-0.7%). While, Portugal (-3.0%) and Spain (-3.1%) had deficits equal to or above 3% of GDP.

At the end of 2017, Estonia (8.7%), Luxembourg (23.0%), Bulgaria (25.6%), Czechia (34.7%), Romania (35.1%) and Denmark (36.1%) registered the lowest ratios of government debt to GDP. Whereas, fifteen Member States had government debt ratios higher than 60% of GDP, with the highest being in Greece (176.1%), Italy (131.2%), Portugal (124.8%), Belgium (103.4%), France (98.5%) and Spain (98.1%).

In addition, as stated by Eurostat, “In 2017, government expenditure in the euro area was equivalent to 47.0% of GDP and government revenue to 46.1%. The figures for the EU28 were 45.8% and 44.8% respectively. In both zones the government expenditure ratio decreased between 2016 and 2017, while the government revenue ratio increased.”

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any Action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein