Date: May 13, 2019

FosRich Company Limited (FOSRICH) for the three months ended March 31, 2019 booked a 39% increase in revenue to total $378.58 million compared to $271.85 million for the same period in 2018. The Company noted, “The growth in revenue has been the direct result of the strategies implemented by the Company to increase its business within the distributive space of our business for specific products such as wires and wiring devices, control devices and panels.”

Cost of sales for the year increased 53%, moving from $143.93 million to $219.50 million. As such, gross profit amounted to $159.08 million, an increase of 24% when compared to $127.93 million recorded last year.

Other income, for the period totalled $9.17 million a contraction of 9% when compared to the $10.10 million recorded for the prior period in 2018.

Administrative and other expenses rose by 19%, to total $114.11 million (2018: $96.23 million). “The increases was driven primarily by staff related costs attributed to both the general increase in salary as well as the decision taken by the Company of strengthening its team in key areas in anticipation of future projects and new revenue streams. The impact on its staff costs is reflected without the associated revenue, however this timing issue will be reversed in the short term. Other investments resulting in increased legal and professional fees; increased selling and marketing costs and increased insurance costs were other factors” the Company noted.

Finance costs of $21.25 million were recorded for the period, a 93% increase when compared to $10.99 million for the corresponding period in 2018. Fosrich noted, “This increase is being driven by a new bond issue, obtained to assist with the financing of new capital projects as well as the solidifying of the Company’s working capital, an important pillar which is critical to the full implementation of the Company’s Strategic Plan. This new facility was obtained at more favourable rates than the previous bank or line of credit facilities.”

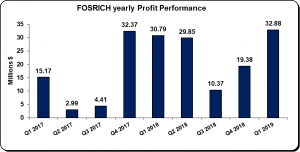

Profit before taxation totalled $32.88 million, a 7% increase when compared to $30.79 million last year.

No taxes were incurred for the period, thus net profit for the three months ended March 31, 2019 totalled $32.88 million, a 7% increase compared to $30.79 million the prior period

Earnings per share (EPS) for the period totalled $0.07 (2018: $0.06). The trailing twelve months earnings per share amounted to $0.18. The number of share used in our calculations amounted to 502,275,555 units. FOSRICH’s stock price close the trading period on May 13, 2019 at $4.76.

Balance Sheet at a glance:

As at March 31, 2019, total assets amounted to $1.97 billion, up $45% million from the balance of $1.35 billion as at March 31, 2018. The increase in total assets was as a result of ‘Inventories’ and ‘Due from Related Parties’ which totalled $949.06 million (2018: $709.70million) and $201.81 million (2018: nil). ‘Accounts receivables’ also increased 163% to total $297.27 million (2018: $113.16 million)

Shareholders’ Equity of $726.23 million was reported as at March 31, 2019 (2018: $639.76 million) which resulted in a book value per share of $1.45 (2018: $1.27).

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.