July 24, 2023

Government debt down to 91.2% of GDP in euro area

The government debt to GDP ratio in the euro area was 91.2% at the end of the first quarter of 2023 compared to 91.4% at the end of the fourth quarter of 2022. The percentage ratio fell from 83.8% to 83.7% in the EU as well. The minor decline in the government debt to GDP ratio for both the EU and the euro area can be attributed to rising GDP, which has outpaced rising government debt in absolute terms. Notable declines were noted in both the euro area and EU government debt to GDP ratio comparable to the first quarter of 2022 (from 95.0% to 91.2%) and (from 87.4% to 83.7%) respectively.

At the end of the first quarter of 2023, debt securities amounted 83% in the eurozone and 82.5% in the EU in total government debt. Loans accounted for 14.2% and 14.7% respectively, while currency and deposits made up 2.8% of both the euro area and EU government debt. Quarterly data on intergovernmental lending (IGL) are also reported because governments of EU Member States are involved in providing financial assistance to some Member States. At the end of the first quarter of 2023, the IGL share as a percentage of GDP was 1.4% in the EU and 1.6 percent in the euro area.

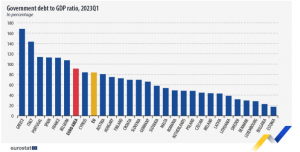

Government debt at the end of the first quarter 2023 by Member State

The highest ratios of government debt to GDP at the end of the first quarter of 2023 were recorded in Greece (168.3%), Italy (143.5%), Portugal (116.8%), Spain (112.8%), France (112.4%), and Belgium (107.4%), and the lowest in Estonia (17.2%), Bulgaria (22.5%), Luxembourg (28.0%) and Denmark (29.4%).

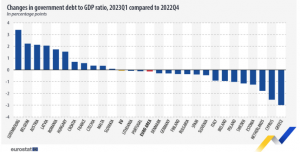

Compared with the fourth quarter of 2022, eleven Member States registered an increase in their debt to GDP ratio at the end of the first quarter of 2023 while sixteen registered a decrease. Increases in the ratio were observed in Luxembourg (+3.4 percentage points – pp), Belgium (+2.2 pp), Austria and Latvia (both +2.1 pp), Romania (+1.7 pp) and Hungary (+1.5 pp). The largest decreases were recorded in Greece (-3.0 pp), Cyprus (-2.5 pp), Netherlands (-1.8 pp), Estonia (-1.2 pp), Sweden (-1.1 pp), Poland (-1.0 pp), Ireland and Italy (both -0.9 pp).

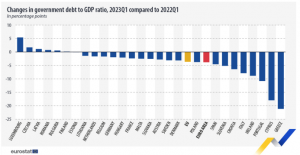

Compared with the first quarter of 2022, six Member States registered an increase in their debt to GDP ratio at the end of the first quarter of 2023 and twenty-one Member States a decrease. Increases in the ratio were recorded in Luxembourg (+5.4 pp), Czechia (+1.7 pp) and Latvia (+1.1 pp), Romania (+0.7 pp), Bulgaria (+0.5 pp) and Finland (+0.2 pp), while the largest decreases were observed in Greece (-21.2 pp), Cyprus (-18.0 pp), Portugal (-10.8 pp), Ireland (-8.9 pp), Italy (-7.9 pp), Croatia (-6.4 pp), Slovenia (-5.2 pp), Spain (-4.6 pp) and Poland (-3.8 pp).

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however, its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned here.