July 25, 2022

Government debt down to 95.6% of GDP in euro area

The government debt to GDP ratio in the euro area was 95.6% at the end of the first quarter of 2022 compared to 95.7% at the end of the fourth quarter of 2021. The percentage fell from 88.1 percent to 87.8 percent in the EU as well. The minor decline in the government debt to GDP ratio for both the EU and the euro area can be attributed to rising GDP, which has outpaced rising government debt in absolute terms. Both the EU and the euro area saw a more significant decline in the government debt to GDP ratio (from 100.0 percent to 95.6 percent) as compared to the first quarter of 2021. (from 92.3 percent to 87.8 percent ). While debt increased in absolute terms, the decreases are the result of a recovery in GDP.

At the end of the first quarter of 2022, debt securities made up 82.9 percent of the debt in the eurozone and 82.5 percent of the debt in the EU. Loans made up 14.0 and 14.5 percent of the euro area’s and the EU’s total government debt, respectively, while money and deposits made up 3.1% and 3.0%. Quarterly data on intergovernmental lending (IGL) are also reported because governments of EU Member States are involved in providing financial assistance to some Member States. At the end of the first quarter of 2022, the IGL share as a percentage of GDP was 1.5 percent in the EU and 1.8 percent in the euro area.

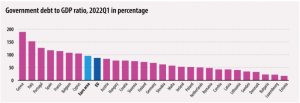

Government debt at the end of the first quarter 2022 by Member State

The highest ratios of government debt to GDP at the end of the first quarter of 2022 were recorded in Greece (189.3%), Italy (152.6%), Portugal (127.0%), Spain (117.7%), France (114.4%), Belgium (107.9%) and Cyprus (104.9%), and the lowest in Estonia (17.6%), Luxembourg (22.3%) and Bulgaria (22.9%).

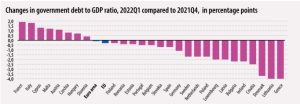

Compared with the fourth quarter of 2021, eight Member States registered an increase in their debt to GDP ratio at the end of the first quarter of 2022 and nineteen a decrease. Increases in the ratio were observed in France (+1.9 percentage points – pp), Italy (+1.8 pp), Cyprus (+1.3 pp), Malta (+1.2 pp), Austria (+1.1 pp), Czechia (+0.8 pp),Hungary (+0.7 pp) and Slovenia (+0.4 pp), while the largest decreases were recorded in Greece and Lithuania (both -4.0 pp), Denmark (-3.7 pp), Croatia (-2.5 pp), Ireland and Bulgaria (both -2.2 pp).

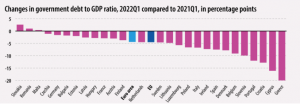

Compared with the first quarter of 2021, three Member States registered an increase in their debt to GDP ratio at the end of the first quarter of 2022 and twenty-four Member States a decrease. Increases in the ratio were recorded in Slovakia (+2.6 pp), Romania (+1.0 pp) and Malta (+0.4 pp), while the largest decreases were observed in Greece (-20.0 pp), Cyprus (-16.1 pp), Croatia (-12.8 pp), Portugal (-12.0 pp), Slovenia (-9.9 pp), Belgium (-9.1 pp), Denmark (-7.8 pp), Spain (-7.5 pp) and Ireland (-7.3 pp).

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however, its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned here.