Date: October 26, 2018

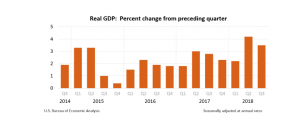

The U.S. Bureau of Economic Analysis indicated that, “Real gross domestic product (GDP) increased at an annual rate of 3.5 percent in the third quarter of 2018. In the second quarter, real GDP increased 4.2 percent.”

The increase in real GDP in the third quarter was a result of positive contributions from personal consumption expenditures (PCE), private inventory investment, state and local government spending, federal government spending, and non-residential fixed investment that were partly offset by negative contributions from exports and residential fixed investment. Also, there was an increase in imports.

Whereas, for the third quarter, the deceleration in real GDP growth reflected a decline in exports and a deceleration in non-residential fixed investment. After declining in the second quarter, imports went up for the following quarter which were partly offset by an upward movement in private inventory investment.

“Current dollar GDP increased 4.9 percent, or $247.1 billion, in the third quarter to a level of $20.66 trillion. In the second quarter, current dollar GDP increased 7.6 percent, or $370.9 billion,” as reported by the BEA.

Additionally, there was a 1.7 percent increase in the price index for gross domestic purchases, in the third quarter, when compared to a 2.4 percent increase in the second quarter. The PCE price index increased 1.6 percent compared with an increase of 2 percent. Furthermore, excluding food and energy prices, there was a 1.6 percent increase in the PCE price index, compared with an increase of 2.1 percent.

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any Action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein