July 8, 2022

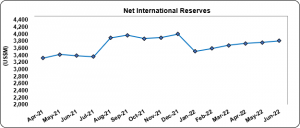

The Bank of Jamaica (BOJ) has reported that Jamaica’s Net International Reserves (NIR) as at June 30, 2022 stood at US$3,804.75 million, reflecting an increase of US$47.45 million when compared to the US$3,757.29 million reported at the end of May 2022.

Foreign Assets totalled US$4,389.91 million, US$15.00 million more than the US$4,374.91 million reported in May 2022. ‘Currency & Deposits’ held by the BOJ as at June 30, 2022 totalled US$3,886.23 million, reflecting an increase of US$37.70 million compared to the US$3,848.53 million reported in May 2022.

‘Securities’ were valued at US$315.85 million; US$18.94 million less than the US$334.78 million reported at the end of May 2022. The country’s ‘Special Drawing Rights & IMF Reserve Position’ fell marginally to US$187.84 million from the US$191.59 million reported last month. Liabilities to the IMF were reduced by US$32.45 million to US$585.17 million against the US$617.61 million reported at the end of May 2022.

At its current value, the nation’s international reserve is $416.04 million, or 12% more than the $3,388.70 million held by the BOJ on June 30, 2021. The current NIR supports approximately 36.11 weeks of goods imports and 24.49 weeks of goods and services imports.

According to the BOJ, the relatively healthy NIR level sends a positive signal about the country’s ability to respond to economic shocks. However, in a press release, the BOJ mentioned, ‘although the COVID-19 cases have declined and the labour market has shown signs of improvement, the uncertainty surrounding the virus is still high. Global markets have also been hampered by the geopolitical tension between Russia and Ukraine which has exacerbated the supply bottleneck and pushed many prices higher’. With these developments, the BOJ says it anticipates that foreign exchange flows could be lighter in the short term, which could put a strain on Jamaica’s Net International Reserves.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein