Paramount Trading (Jamaica) Limited (PTL)

For the year ended May 31, 2017 Paramount Trading (Jamaica) Limited recorded a 13% increase in Total Revenues to $1.16 billion from $1.02 billion in 2016. This growth was attributable to 8% or $69.97 million increase in revenues from the “Chemicals” segment which amounted to $912.57 million, along with a 35% increase in “Construction and Adhesives” segment to $109.92 million (2016: $81.37 million). The “Lubricants” increased by 59%, reporting revenues of $72.38 million relative to $45.43 million in 2016. While the “Transport” segment totaled $33.01 million relative to $28.57 million last year, with “Manufacturing” increasing by 6% or $1.61 million to $28 million from $26.39 million in 2016. Revenue for the quarter increased by 18% closing the quarter at $320.12 million (2016: $271.49 million)

Direct expenses closed the period at $801.83million, an increase of approximately $113.27 million relative to the $688.56 million reported a year ago. Despite the increase, gross profit grew by approximately 5% to $354.04 million (2016: $335.79 million). Other operating income totaled $11.67 million for the year, a 70% decline relative to last year $38.82 million.

Administrative expenses increased by 22% to $220.28 million, up from the $180.97 million recorded for the 2016FY. Selling and distribution expenses also increased by 171%, closing at $34.79 million (2016: $12.84 million). Finance income totalled $1.11 million a 36% decline when compared to $1.72 million a year ago, while Finance costs totaled $10.75 million up from $9.48 million a year ago, an increase of 13%.

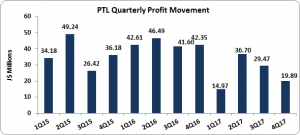

Consequently, Pre-tax profit amounted to $101 million, 42% less than the $173.04 million reported in 2016. No taxes were charged for the year due to the remission of taxes as a result of listing on the Junior Market of the Jamaica Stock Exchange. As such, Net profit attributable to shareholders totalled $101 million (2016: $173.04 million). Net Profit for the quarter amounted to $19.89 million (2016: $42.35 million)

Earnings per share for the year totalled $0.07 (2016: $0.11). Earnings per share for the fourth quarter were $0.01 cents relative to earnings per share of $0.03 cents for the same period last year. The number of shares used in our calculations is 1,542,467,080 units.

Balance Sheet Highlights:

As at May 31, 2017, the company’s assets totaled $1.02 billion, $161.58 million more than the $859.69 million quoted a year ago. The main contributor to this growth was the increase in Property, Plant & Equipment which increased 90% to close at $239.97 million compared to $126.57 million booked as at May 31, 2016. Inventories and Receivables and Pre-payment also contributed to the increase with an 18% and 9% increase to close at $367.06 million (2016: $336.32 million) and $304.62 million (2016: $257.55 million) respectively.

Shareholder’s equity as at May 31, 2017 stood at $681.78 million (2016: $580.78 million) resulting in a book value per share of $0.44 (2016: 0.38). The number of shares used in our calculations is 1,542,467,080.