May 17, 2021

Productive Business Solutions Limited (PBS) for the three months ended March 2021 reported an 18% increase in revenues from US$41.91 million for the 2020 period to US$49.34 million in 2021. PBS noted the increase was, “led primarily by the technology segment of the Company. The last two quarters the company generated $100.0 Million in revenues, setting a record for PBS since becoming publicly traded.”

Furthermore, “Our Information Technology portfolio has increased its pipeline from Q4 2020 which should ensure our continued revenue growth by winning additional deals in the Caribbean and Central America. These transactions will be recognized throughout 2021 and beyond. We continued to focus on margin improvements as well as cost reduction programs to ensure strong results in this fiscal year.”

Direct expenses increased 46% to close the period at US$33.72 million when compared to $23.16 million for the same period of 2020. As such, gross profit for the period under review decreased by 17% to close at US$15.62 million (2020: US$18.74 million).

Other income rose by 91% totalling US$90,000 relative to US$47,000 in the prior corresponding period.

Selling, general and administrative expenses amounted to US$13.51 million (2020: $16.01 million), a 16% decline year over year.

As such, operating profit went down 21% for the period to total US$2.20 million relative to US$2.78 million in the prior comparable period.

Finance costs decreased 33% to total US$1.79 million versus US$2.66 million in 2020. As such, profit before taxation amounted to US$419,000 relative to a profit of US$121,000 in 2020.

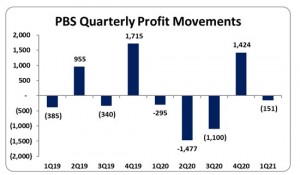

After taxation of US$565,000 (2020: US$398,000), the Company reported net loss of US$146,000 (2020: loss US$398,000). Net loss attributable to shareholders amounted to US$151,000 for the three months ended March 31, 2021 versus a net loss attributable to shareholders of US$295,000 in the comparable period last year.

Total comprehensive loss for the period was US$7,000 versus loss of US$613,000 in the same period last year. Comprehensive loss attributable to shareholders for the period under review amounted to US$15,000, an improvement compared to 2020’s comprehensive loss of US$630,000.

For the period the company reported a loss per share (LPS) of US$0.0012 (LPS 2020: US$0.0022). The twelve month trailing EPS was US$0.0020. The total number of shares employed in our calculations amounted to 123,272,727 units. The stock price closed trading on May 14, 2021 at US$1.01.

PBS highlighted, “The rebound in revenue from Q1 2021 was despite Barbados, Curacao, Dominican Republic and Panama continuing to have restrictive lockdowns and weakened economies.” The company further stated that, “PBS has continued to adapt its coverage strategy and has shifted to a vertical industry coverage model. PBS has focused its efforts by aligning its sale coverage to central governments, education ministries, banks, telecommunications, manufacturing and distribution market segments. We believe this has allowed us to react quickly to the marketplace.”

“Our printing side of the business is slowly regaining traction as some economies begin to reopen. In the midst of Covid-19 shutdowns our printing volumes dropped 50%. Although Q1 2021 printing volumes has rebounded, it still reflects a decrease of 20% versus prior year comparable quarter.” as noted in PBS first quarter report.

Balance Sheet at a glance:

As at March 2021, PBS had total assets totalling US$182.14 million (2020: US$181.57 million), which represents a marginal increase of 0.31%. This movement was mainly attributed to ‘Contract Assets’ which stood at US$11.86 million (2020: nil), but the increase was off set by ‘Inventories’ which decreased by US$10.89 million to US$29.61 million (2020: US$40.50 million).

Shareholders Equity amounted to US$32.75 million (2020: US$34.58 million) with a book value per share of US$0.266 (2020: $0.281).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.