May 17, 2021

Eppley Limited (EPLY) for the three months ended March 31, 2021, reported interest income of $71.39 million a 22% decline when compared $91.29 million recorded for the corresponding period in 2020.

Interest expenses for the period amounted to $54.05 million, an 8% increase when compared to $50.03 million recorded in the prior year.

Consequently, net interest income for the quarter fell 58% to total $17.34 million down from the $41.26 million recorded in the corresponding period of 2020. EPLY noted, “Interest income was down sharply on account of both lower loan volumes and lower weighted average interest rates. We also experienced an FX loss in the quarter. These negative factors were more than compensated for by the continued strong performance of our asset management business.”

Other operating income for the period under review amounted to $10.82 million versus $7.28 million reported in 2020.

Administrative expenses rose 20% for the quarter to close at $49.51 million up from $41.21 million recorded for the first quarter of 2020. Also, ‘Net impairment gains of financial and contract assets’ amounted to $285,000 for the period under review relative to a loss of 67,000 for the same period in 2020. Asset management income closed at $73 million (2020: $34.22 million).

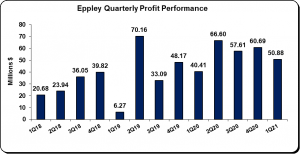

As such, pre-tax profit closed at $51.93 million for the first three months of 2021, 25% greater than the $41.48 million booked in 2020. Taxation at the end of March 2021 amounted to $1.04 million (2020: $1.07 million), resulting in a net profit attributable to shareholders of $50.88 million, an increase of $10.47 million from the $40.41 million recorded for the same quarter in 2020.

Total comprehensive income for the three months ended March 2021 closed at $50.92 million, a 60% increase when compared to $31.77 million booked the corresponding period.

Earnings per share for the quarter amounted to $0.26 (2020: $0.21). The trailing twelve months earnings per share amounted to $1.23. The total amount of shares outstanding used for this calculation was 192,468,300 units. Notably, the stock price for EPLY closed the trading period on May 17, 2021 at JMD $34.04 with a corresponding P/E ratio of 27.78 times.

EPLY noted, “Eppley remains well capitalized with ample “dry powder” on its balance sheet and in its funds. Our business model, culture and investment philosophy are designed to thrive in current market environment.”

Furthermore, “As we look ahead, we are cautiously optimistic about the opportunities we see to put significant capital to work on behalf of our investors and shareholders in 2021.”

Balance Sheet Highlights:

As at March 31, 2021, total assets amounted to $4.29 billion, relative to the $4.03 billion recorded a year ago. The 7% increase in assets was driven primarily by ‘Lease Receivable’, which climbed by 37% to close at $708.85 million (2020: $518.98 million).

Shareholder’s Equity as at March 31, 2021, totalled $895.17 million (2020: $785.97 million) resulting in a book value per share of approximately $4.65 relative to the $4.08 reported in 2020.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.