Date: May 15, 2019

PanJam Investments Limited (PJAM) for the three months ended March 31, 2019, reported a 12% increase in total income to total $583.08 million relative to $522.88 million booked for the prior year’s corresponding period. Of total income:

Other income declined 1% from $32.23 million to $32.03 million.

Investments went up grossly by 119% to close at $94.12 million (2018: $42.93 million). It was mentioned that, “this was positively impacted by higher unrealised gains, which outweighed a foreign exchange loss and lower dividends and realised gains.”

Property income inched up 2% to $456.92 million (2018: $447.72 million). Management noted that, “the increase was due to improved rentals, though net lease income and revaluation gains declined.”

Operating expenses amounted to $401.17 million for the three months ended March 31, 2019 (2018: $371.60 million), 8% more than its total a year prior. PJAM stated that, “this increase was principally as a result of higher costs for building out rental space, insurance and staff-related items.”

Consequently, operating profits increased by 25% to a total of $190.13 million relative to $151.91 million recorded in the prior corresponding period.

Finance costs for the period rose by 6%, amounting to $171.38 million compared to the $160.94 million for the comparable period in 2018. Share of results of associated companies improved to close the quarter at $889.38 million (2018: $855.51 million).

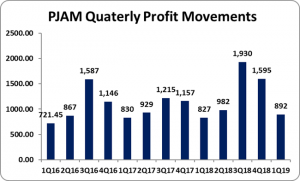

Profit before taxation went up 7%, closing the period at $908.13 million (2018: $846.47 million). Following taxation of $13.04 million (2018: $11.15 million), net profit amounted to $895.08 million (2018: $835.33 million).

Net profit attributable to shareholders for the period amounted to $891.62 million from the $827.02 million recorded in the year prior.

Consequently, earnings per share for the period amounted to $0.836 (2017: $0.776). The twelve month trailing earnings per share is $5.06. The number of shares used in the calculation is 1,066,159,890 units. Notably, PJAM’s stock price closed the trading period on May 14, 2019 at a price of $96.35.

PJAM highlighted that, “PanJam has increased its investment in Jamaica and continues to seek additional opportunities. We also maintain our encouragement of additional measures by the government to improve efficiency of the regulatory and approval processes necessary to facilitate growth, as well as actions to reduce the high crime levels which remain a drag on the economy. The recent reductions to transfer tax and stamp duty, will stimulate development and contribute to maintaining or improving economic growth.”

Balance Sheet at a glance:

As at March 31, 2019, PanJam Investments Limited (PJAM) had assets totalling $47.25 billion, a 21% increase relative to $39.18 billion a year prior. The growth was attributed to an increase in ‘Financial assets at fair value through profit and loss’ and ‘Investment in associated companies’ which amounted to $6.65 billion (2018: $2.63 billion) and $28.12 billion (2018: $24.23 billion), respectively.

Shareholders Equity amounted to $35.16 billion (2018: $30.54 billion) with a book value per share of $32.98 (2018: $28.65).

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.