Revenue increased 11.5% year on year, closing the year at $391.00 million, up from $350.58 million in 2016, while for the quarter revenue amounted to $127.34 million down 5.1% compared to the $134.23 million booked in 2016.

Administrative and Other Expenses increased 7.15%, closing the year at $217.12 million relative to 2016’s $202.63 million.

As such, Operating Profit increased 17.5%, closing the year at $173.88 million compared to the $147.95 million posted in 2016.

Other income amounted to $97.62 million, a 2.9% increase on the $94.88 million recorded for the 2016 financial year.

This resulted in Profit before finance costs of $271.50 million, an increase of 11.8% relative to the $242.83 million recorded last year.

Finance Cost decreased by 17.6%, closing the year at $3.09 million (2016: $3.75 million).

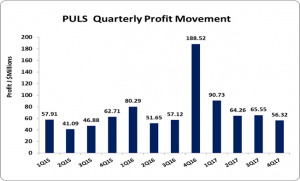

Net Profit attributable to members fell by 26.68%, closing the year at $276.85 million, down from $377.58 million a year ago, while for the quarter Net Profit totaled $56.32 million relative to $188.52 million reported in 2016.

Earnings per share amounted to $1.02 for the year relative to $1.39 in 2016. The number of shares used in the calculations is 271,789,674 units.

Total Comprehensive Income for the year amounted to $312.7 million relative to the $368.08 million booked in 2016, a 15% decline.

Balance Sheet Highlights

Assets totaled $2.48 billion, a year over year increase of 16.98% percent relative to the $2.12 billion booked the year prior. This movement was driven by an increase in Investment Properties totaling $1.48 billion (2016: $1.31 billion) and Advertising Entitlements totaling $567.24 million (2016: $439.24 million).

Shareholder’s Equity as at June 30, 2017 stood at $2.29 billion (2016: $2.00 billion) resulting in book value per share of $8.42 (2016: $7.35).