Date: August 14, 2018

Radio Jamaica Limited (RJR), revenue for the first three months ended June 30, 2018, increased by 10% from $1.22 billion in 2017 to $1.35 billion. RJR highlighted that, “The increase was largely due to a revenue boost from the staging of a part of the 2018 FIFA World Cup Football competition during the first quarter.”

Direct expenses increased to $749.61 million, this compares to the prior year’s figure of $635.52 million, representing an increase of 18%. The company noted that, “This was a result of the rights and technical fees associated with the 2018 FIFA World Cup project resulting in an overall positive impact on Gross Profit for the quarter over prior period.”

As such, gross profit amounted to $597.44 million relative to $583.64 million for the corresponding period in 2017.

Operating costs increased slightly for the period under review by 1% from $661.87 million in 2017 to $668.32 million in 2018. There was a 2% increase in selling expenses to $197.29 million (2017: $192.72 million), and a 0.3% growth in administrative expenses to $290.86 million (2017: $290.11 million). Other operating expenses rose 0.62% to $180.16 million relative to $179.04 million in 2017.

Other income declined for the period to $22.36 million compared to the 2017 figure of $41.98 million. The company indicated that, “The reduction was driven by exchange rate revaluation, as well as lower earnings on the investment portfolio.”

Operating loss widened by 34% for the period in review, from $36.26 million in 2017 to $48.52 million in 2018.

Finance costs increased 182% year on year to $16.87 million when compared to the corresponding period in 2017 figure of $5.97 million. RJR stated that, “The increase for the period was mainly due to external financing, in the latter part of the previous financial year, of the acquisition of a high definition outside broadcast truck as well as an energy efficiency project.”

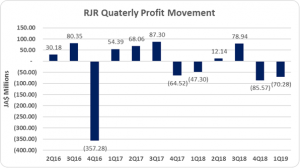

Tax expenses decreased by 5% to $4.80 million from $5.06 million. Consequently, Net Loss for the period increased by 48% to $70.19 million relative to a loss of $47.30 million for the prior year’s corresponding period in 2017.

The loss per share (LPS) for the three-month period amounted to $0.029 versus $0.020 in 2017. The twelve months trailing loss per share is $0.027. The number of shares used in this calculation was 2,422,487,654 units. RJR stock last traded on August 14, 2018 at $1.05.

The company highlighted that, “The Group continues its investment to transition to High Definition (HD) production and broadcast. Having made the investment in the television services business unit, the integration, training and monetization activities are all now in train with the desired return on that investment targeted for the medium term. The changes in radio and print will join the dramatic Digital Switch Over changes for TV, as the entire Group re-positions itself and diversifies its revenue streams for the future. Digital switchover will enable the distribution of a digital signal to all corners of the island which will improve the viewing and listening experience as well as provide exciting “spin off” services of public.”

Balance Sheet Highlights:

The company, as at June 30, 2018, recorded total assets of $3.83 billion, a decrease of 4% when compared to $3.99 billion for the previous corresponding period.

Total Stockholders’ equity as at June 30, 2018 closed at $2.33 billion, down 9% from $2.55 billion last year. This resulted in a book value of $0.96 compared to a 2017 value of $1.05.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.