Date: May 14, 2019

Sweet River Abattoir & Supplies Company Limited (SRA) for the year ended March 31, 2019 recorded a 19% decline in revenue to $245.12 million relative to $304.41 million in the same period in 2018. Revenue for the quarter went down 28% to close at $46.60 million relative to $64.99 million in the prior comparable period. The Company stated that, “this decrease was due to a reduction in the amount of pigs slaughtered during the quarter based on the Company’s indebtedness to pig farmers.”

SRA mentioned that, “sales were lower in 2019 as a result of us slaughtering fewer animals while some costs remain unchanged. The entry of a new processor combined with an attrition of farmers resulted in less pigs available and thus higher pig price. These higher price most time cannot be passed on immediately due to contractual arrangements.”

Cost of sales fell by 21% from $256.45 million in 2018 to $201.61 million in 2019. As a result, gross profit declined to $43.51 million, a 9% drop when compared to $47.96 million for the same period of 2018. For the quarter, gross profit closed at $5.66 million (2018: $926,319). Management noted that, “this was a result of a price increase to the company’s largest customers.”

Administrative expenses reported a decrease of 66% from $165.63 million for the year ended March 31, 2018 to $56.84 million in 2019. For the quarter, administrative expenses closed at $16.42 million (2018: $11.28 million). It was indicated that, “this increase was due to utilities, repair and maintenance and administrative expenses.”

Consequently, SRA recorded operating loss for the period under review of $13.33 million, a decrease of 89% when compared to operating loss of $117.67 million booked for the prior corresponding period. Operating loss for the quarter amounted to $10.76 million (2018: $10.35 million).

Finance cost closed the period at $14.65 million, a decline of 27% versus $20.13 million for the corresponding period last year, while finance income totalled $27,237 (2018: $38,139).

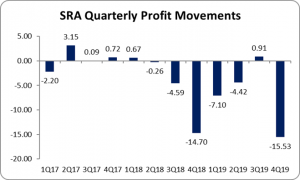

Furthermore, loss before taxation amounted to $27.96 million compared to pretax loss of $137.76 million in the same period in 2018. Loss before taxation for the quarter totalled $15.53 million (2018: $14.70 million).

As a result, SRA recorded net loss of $27.96 million for the year ended March 31, 2019 relative to a loss of $113.15 million in the corresponding period in 2018. The Company booked loss for the quarter of $15.53 million versus loss of $14.70 million in the comparable quarter of last year.

The loss per share (LPS) for the period amounted to $0.34 versus a LPS of $1.39 for the corresponding period last year. The LPS for the quarter totalled $0.19 compared to a LPS of $0.18 for the similar period of 2018. The number of shares used in this calculation was 81,531,043 units. The stock price last traded on May 14, 2019 at $3.02.

Additionally, management stated that, “while our performance in 2019 is better than that of 2018 we operated at a loss and corrective measures are being looked at to address the challenges. One measure being contemplated is for the company to acquire a finishing barn and grow pigs to cover for shortfalls in the market. Another measure is to have selected farmers grow on exclusive contract where some raw materials are provided by the Company.”

Balance Sheet Highlights:

As at March 31, 2019, SRA recorded total assets of $395.39 million, a decline of 4% when compared to $412.64 million for the same period last year. The decline in the total asset base was attributed to ‘Cash and Cash Equivalents’ and ‘Property, Plant and Equipment’ which closed at $4.77 million (2018: $15.78 million) and $318.69 million (2018: $330.49 million), respectively.

Total stockholders’ equity as at March 31, 2019 closed at $21.20 million, down 57% from $49.16 million last year. This resulted in a book value of $0.26 (2018: $0.60).

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.