November 17, 2020

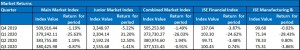

The weak performance in the equities market thus far in 2020 reflects low investor interest due to continued uncertainty about the prospects for the economy, stemming from the COVID-19 pandemic. For the third quarter ended September 2020, all the Jamaica Stock Exchange (JSE) indices recorded declines. “Stock price appreciation during the quarter was largely concentrated among the Financial sector. The Manufacturing and Other categories accounted for most of the declining stocks for the September 2020 quarter as per The Bank of Jamaica (BOJ)”.

As at the end of November 2020, the Jamaica Stock Exchange’s (JSE) Main and Junior Market Indices have both trended downwards since the start of the year with declines of 21.64% and 24.87%, respectively, as at November 30, 2020. Month over month, both markets appreciated by 6.44% and 1.86%, respectively.

Trade Statistics

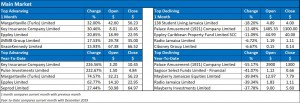

The value and number of transactions on both markets have declined and may be influenced by the environment’s current sentiment. Year to date, the transactions on the Main Market trended upwards by 41.02%, while volumes and value fell 24.20% and 50.36%, respectively. Relative to November 2019, the number of transactions completed on the Main Market rose 4.23% as volumes saw an increase of 6.09% over October’s outturn. The number of transactions completed as at November 30, 2020, amounted to 158,950 relative to 112,718 as at November 2019. As of November 30, 2020, volumes and value stood at 6.24 billion units (November 2019: 8.23 billion units) and $42.24 billion (November 2019: $91.76 billion).

Main Market Trade Statistics

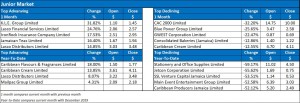

Transactions on the Junior Market trended upwards year to date (54.35%), while volumes and value fell 38.94% and 51.26%, respectively. Relative to November 2019, the number of transactions completed on the Junior Market rose to 89.44%, as volumes saw an increase of 85.47% over November 2019’s outturn. The number of transactions completed as at November 30, 2020, amounted to 61,697 relative to 39,971 as at November 2019. Volumes and value as at November 30, 2020, stood at 1.56 billion units (November 2019: 2.87 billion units) and $4.18 billion (November 2019: $9.39 billion).

Junior Market Trade Statistics

Top Advancers and Decliners

For November 2020, the Main Market’s month over month top advancer was Margaritaville (Turks) Ltd, which opened the month at $42.60 and ended at $56.23, representing a 32% increase. The top decliner was 138 Student Living Jamaica Ltd, after opening November 2020 at $4.89 and closing at $4.00, representing an 18.20% decline. The top year to date advancer, Key Insurance Company Ltd, saw a 226.56% uptick after opening at $3.20 and closing at $10.45. The top year to date decliner was Palace Amusement Company Ltd., which saw a decline of 55.17% after opening 2020 at $2900.

The Junior Market’s month over month top advancer for November 2020 was K.L.E Group Ltd., which opened the month at $1.10 and ended at $1.45, representing a 31.82% increase. The top one-month decliner CAC 2000 Ltd, opened the month at $14.75 and ended at $10.00, representing a 32.20% decline. The top year to date advancer, Caribbean Flavours & Fragrances Ltd., saw an 18% uptick, after opening at $1.50 and closing at $1.77. The top year to date decliner, Stationery and Office Supplies Ltd, saw a decline of 59.17% after opening at $11.02 and closing the period at $4.50.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.