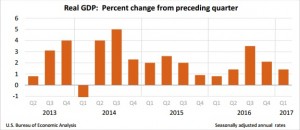

The Bureau of Economic Analysis (BEA) today revised the U.S. Gross Domestic Product (GDP) growth for the January to March quarter of 2017 to 1.4%. This was the third estimate of the quarter following the availability of more complete data which was previously not available for the second estimate. The previous estimate produced a revision of 1.2% for the quarter. However with more comprehensive data available, the U.S. economic growth was less tepid than previously reported. The latest upward revision was attributed to increases in personal consumption expenditures (PCE) and exports increased more than previously expected. Despite the revision for the quarter the Commerce Department noted, “the general picture of economic growth remains the same.” For the fourth quarter of 2016, real GDP increased by 2.1%.

The BEA highlighted, “the increase in real GDP in the first quarter primarily reflected positive contributions from nonresidential fixed investment, exports, PCE, and residential fixed investment that were partly offset by negative contributions from private inventory investment, federal government spending, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.” However according to the BEA, “the deceleration in real GDP in the first quarter reflected a downturn in private inventory investment, a deceleration in PCE, and a downturn in state and local government spending that were partly offset by an upturn in exports, an acceleration in non-residential fixed investment, and a deceleration in imports”.

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.