December 31, 2020

U.S. International Investment Position, Third Quarter 2020

U.S Bureau of Economic Analysis (BEA) latest report about U.S. net international investment position, shows a decrease of $865.6 billion from Q2 to Q3. This was as result of an $870.3 billion decrease in net position excluding financial derivatives, however slightly offset by a $4.7 billion increase in net financial derivates other than reserves. The BEA noted, “the difference between U.S. residents’ foreign financial assets and liabilities, was –$13.95 trillion at the end of the third quarter of 2020”. Also, “Assets totaled $29.41 trillion and liabilities were $43.36 trillion.”

Notably, At the end of the second quarter, the net investment position was –$13.08 trillion.

It was further noted, “the –$865.6 billion change in the net investment position from the second quarter to the third quarter came from net financial transactions of –$219.9 billion and net other changes in position, such as price and exchange rate changes, of –$645.7 billion.”

Coronavirus (COVID-19) Impact on Third Quarter 2020 International Investment Position

According to the BEA, “The full economic impact of the COVID-19 pandemic cannot be quantified in the IIP statistics because the impacts are generally embedded in source data and cannot be separately identified.”

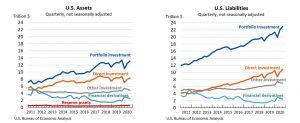

It was reported that, “The In the third quarter of 2020, U.S. assets and liabilities continued to increase, reflecting increases in portfolio investment and direct investment assets and liabilities.” Furthermore, “most of the currency swaps between the U.S. Federal Reserve System and foreign central banks that remained at the end of the second quarter were ended in the third quarter, contributing to the continued U.S. withdrawal of deposit assets and the continued U.S. repayment of deposit and loan liabilities.” In addition, BEA explained that, “these currency swaps were initiated in the first quarter to alleviate the dollar shortage overseas at the onset of the COVID-19 pandemic. Separately, in the third quarter, a record level of net shipments of U.S. currency abroad to meet the demand for U.S. currency by foreign residents increased U.S. currency liabilities, partly offsetting the net repayment of U.S. deposit liabilities.”

U.S. assets went up by $629.2 billion, to total $29.41 trillion at the end of the third quarter, reflecting rise in portfolio investment and direct investment assets that were partly offset by a $205.6 million decreases in financial derivatives other than reserves. Notably, “portfolio investment assets increased by $684.7 billion, to $13.07 trillion, and direct investment assets increased by $370.8 billion, to $8.32 trillion, driven mainly by the appreciation of major foreign currencies against the U.S. dollar and by foreign stock price increases that raised the value of these assets,” as per BEA.

U.S. liabilities rose by $1.49 trillion, to total $43.36 trillion at the end of the third quarter, reflecting increases in portfolio investment and direct investment liabilities that were partly offset by decreases of $210.3 million in financial derivatives and in other investment liabilities. It was noted, “portfolio investment liabilities increased by $967.8 billion, to $23.01 trillion, and direct investment liabilities increased by $762.3 billion, to $10.85 trillion, driven mainly by U.S. stock price increases that raised the value of these liabilities.”

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.